CPA Pilot

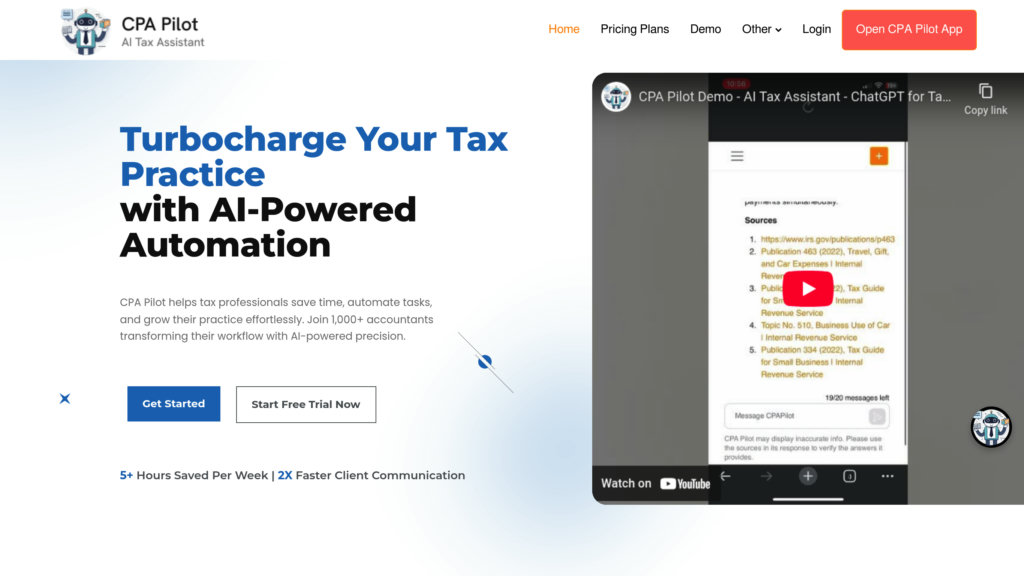

AI-powered assistant tailored for tax professionals to automate research, client communication, and marketing, enhancing productivity and accuracy.

Community:

Product Overview

What is CPA Pilot?

CPA Pilot is a specialized AI assistant designed exclusively for tax accountants and professionals. It leverages advanced AI, including GPT-4 technology, to streamline complex tax research, automate client communications, and generate marketing content. By integrating authoritative tax codes and resources from all 50 states, CPA Pilot delivers highly accurate, reliable answers that outperform general AI chatbots. It helps users save significant time, reduce errors, and grow their practice by automating repetitive tasks and providing instant technical support.

Key Features

Tax-Specific AI Research

Access precise, up-to-date tax law information, IRS forms, publications, and state regulations with AI trained specifically for tax professionals.

Automated Client Communication

Quickly draft detailed client emails, instructional letters, and responses to common tax questions, improving client satisfaction and reducing workload.

Marketing Content Generation

Create niche-targeted newsletters, social media posts, and marketing materials to attract and retain clients effortlessly.

Instant Technical Support

Receive immediate assistance with tax software and tax-related queries, minimizing downtime and the need for external support.

High Accuracy with Authoritative Sources

Delivers answers with up to 95% accuracy by relying solely on verified tax codes and official publications, reducing AI hallucinations.

Flexible Subscription Plans

Affordable pricing tiers with message rollovers and team sharing options to fit solo practitioners and growing firms.

Use Cases

- Tax Research and Analysis : Perform complex tax research quickly to provide clients with accurate advice on federal and state tax matters.

- Client Communication Automation : Automate routine client emails and explanations, freeing up time to focus on personalized tax planning.

- Practice Marketing : Generate engaging marketing content that targets specific tax niches to grow your client base.

- Staff Training and Support : Use CPA Pilot to train staff on tax topics and software without external resources.

- Compliance and Payroll Assistance : Ensure payroll and 1099 compliance with quick, accurate AI guidance.

FAQs

CPA Pilot Alternatives

TaxGPT

AI-powered tax assistant designed to streamline tax research, writing, and document management for tax professionals and businesses.

Tributi

Simplifies tax declaration process with an intuitive, automated platform for individuals in Latin America.

Thomson Reuters

Global provider of integrated AI-powered legal, tax, accounting, and risk management solutions designed to enhance professional services efficiency and compliance.

Deel

A comprehensive global payroll and compliance platform for managing international teams.

Keeper Tax

AI-powered tax filing and expense tracking software designed for freelancers, independent contractors, and small business owners to maximize deductions and simplify tax filing.

Accountable

All-in-one AI-powered finance app for self-employed professionals in Germany, covering bookkeeping, invoicing, banking, and taxes with guaranteed accuracy.

ANNA Money

AI-powered business account and tax app designed to simplify financial admin for small businesses and freelancers.

PromisePay

AI-powered platform offering flexible, interest-free payment plans and streamlined government and utility relief distribution to boost revenue recovery and customer satisfaction.

Analytics of CPA Pilot Website

🇺🇸 US: 95.56%

🇮🇳 IN: 4.43%

Others: 0%