Accountable

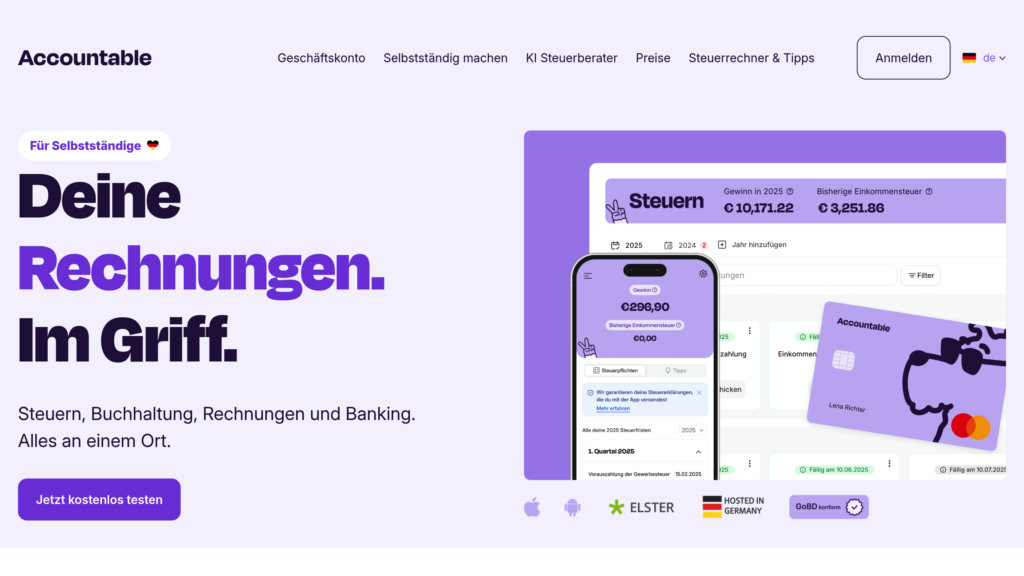

All-in-one AI-powered finance app for self-employed professionals in Germany, covering bookkeeping, invoicing, banking, and taxes with guaranteed accuracy.

Community:

Product Overview

What is Accountable?

Accountable is a comprehensive financial management platform tailored for freelancers, small business owners, and self-employed individuals in Germany. It integrates AI-driven tax filing, automated bookkeeping, professional invoicing, and banking features into a single user-friendly app. Designed to simplify complex tax obligations, Accountable enables users to manage their finances confidently without prior tax knowledge, backed by a tax guarantee that covers errors up to €5,000. The platform supports VAT, income tax, and business tax filings, while offering personalized tax advice and seamless collaboration with tax advisors.

Key Features

AI-Powered Tax Filing

Automates VAT, income, and business tax returns with direct submission to German tax authorities, ensuring error-free filings backed by a refund guarantee.

Automated Expense Management

Scan receipts and link expenses to bank transactions automatically, maximizing deductible expenses with real-time tracking and tailored tax tips.

Professional Invoicing

Create legally compliant, customizable invoices easily, supporting multi-currency and PEPPOL e-invoicing standards for faster payments.

Integrated Banking and Bookkeeping

Connect bank accounts for real-time cash flow monitoring, automatic bookkeeping updates, and accurate tax reserve calculations.

Personalized Tax Support

Access certified tax advisors and tax coaches via chat, email, or phone for expert guidance, plus AI-driven instant answers to tax questions 24/7.

Security and Compliance

Operates under BaFin supervision with PSD2 licensing, employing top-level encryption and regular audits to protect user data.

Use Cases

- Freelancer Financial Management : Freelancers can handle invoicing, track expenses, and file taxes independently with AI assistance and professional support.

- Small Business Bookkeeping : Small business owners streamline bookkeeping and tax submissions, ensuring compliance and maximizing deductions without an accountant.

- Tax Filing for Self-Employed : Self-employed professionals can submit VAT, income, and business tax returns confidently with error-free guarantees and automated workflows.

- Invoice and Payment Management : Users create compliant invoices, send them digitally, and receive payment notifications, improving cash flow and client communication.

- Real-Time Financial Insights : Integrated banking provides live updates on income, expenses, and tax liabilities, enabling better financial planning and spending decisions.

FAQs

Accountable Alternatives

Keeper Tax

AI-powered tax filing and expense tracking software designed for freelancers, independent contractors, and small business owners to maximize deductions and simplify tax filing.

ANNA Money

AI-powered business account and tax app designed to simplify financial admin for small businesses and freelancers.

Every

Comprehensive back-office platform integrating incorporation, banking, payroll, bookkeeping, taxes, and compliance for startups.

Keeper

Comprehensive tax and bookkeeping software designed to streamline expense tracking, client communication, and tax filing for independent contractors and bookkeepers.

Clemta

Comprehensive AI-powered platform for seamless US business formation, management, and compliance tailored for global entrepreneurs.

Finta

All-in-one platform simplifying accounting, tax filing, and fundraising management with automation and real-time insights.

Paula

Conversational accounting platform providing real-time bookkeeping automation, invoice generation, and financial insights for small businesses and freelancers.

Beluga Labs

Automated finance platform for creators, simplifying income tracking, maximizing deductions, and streamlining quarterly tax payments.

Analytics of Accountable Website

🇩🇪 DE: 88.1%

🇺🇸 US: 3.04%

🇮🇹 IT: 1.3%

🇬🇧 GB: 1.03%

🇦🇹 AT: 0.86%

Others: 5.67%