Peakflo

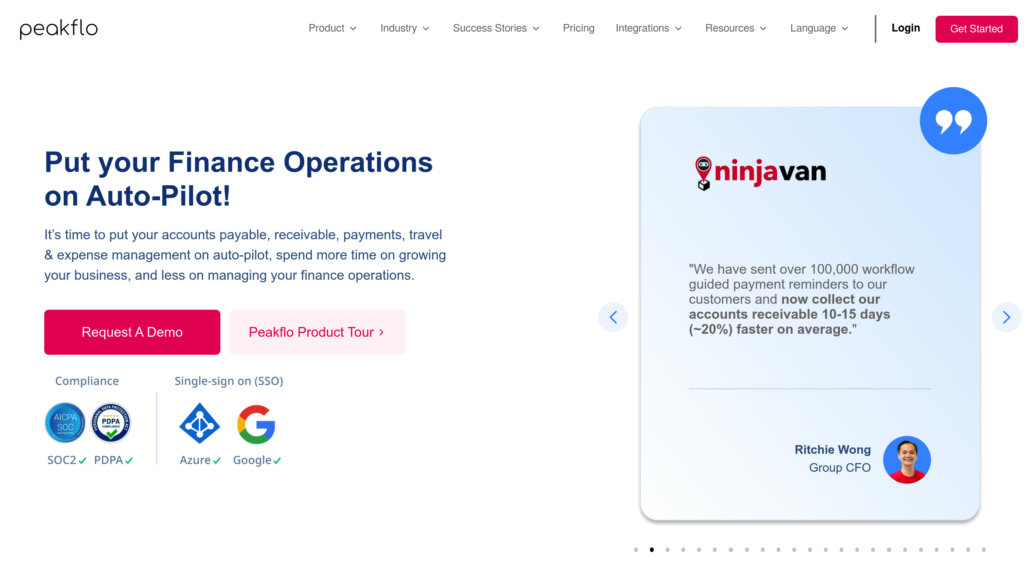

AI-powered finance automation platform that streamlines accounts receivable, accounts payable, and procurement workflows to optimize cash flow and operational efficiency.

Community:

Product Overview

What is Peakflo?

Peakflo is an AI-driven finance operations automation platform designed to simplify and accelerate invoice-to-cash and procure-to-pay processes. It integrates seamlessly with existing ERP and accounting software to automate invoice capture, payment reminders, approval workflows, and reconciliation tasks. By leveraging AI for predictive payment behavior, customizable workflows, and real-time reporting, Peakflo empowers finance teams to reduce manual workloads, improve cash collections, and optimize vendor payments, enabling strategic focus on high-value activities.

Key Features

AI-Powered Invoice Capture

Automatically digitizes and structures invoices using AI-driven OCR, capturing custom fields and eliminating manual data entry.

Automated Accounts Receivable Management

Tracks customer payments, sends multi-channel reminders (email, WhatsApp, SMS), predicts payment behavior, and reduces days sales outstanding.

Procure-to-Pay Automation

Streamlines purchase order approvals, 3-way matching, vendor onboarding, and automated bill payments with role-based access and e-signatures.

AI-Powered Reporting and Analytics

Provides real-time insights on cash flow, aging balances, disputed invoices, and customer risk segmentation for proactive financial management.

Centralized Vendor and Customer Portals

Facilitates transparent communication, dispute resolution, and collaboration with vendors and customers through dedicated portals.

Travel and Expense Management

Simplifies travel requests, expense reporting, and reimbursements with automated workflows to control costs efficiently.

Use Cases

- Finance Teams in Enterprises : Automate high-volume invoice processing, payment collections, and vendor payments to save thousands of man-hours monthly.

- Accounting Firms : Manage multiple client accounts with role-based access, streamline invoicing, and automate reconciliations to boost client satisfaction.

- Logistics and Manufacturing : Eliminate manual bottlenecks in procurement and payment workflows to improve cash flow and operational forecasting.

- Marketplaces and Online Travel Businesses : Set rules-based workflows for end-to-end payment collections and mass payouts to vendors and partners.

- Small and Medium Businesses : Leverage AI-powered reminders and predictive analytics to reduce overdue invoices and improve working capital management.

FAQs

Peakflo Alternatives

Inscribe AI

A fraud detection and document automation platform that streamlines financial document review and risk assessment with advanced machine learning.

Ramp

An all-in-one finance automation platform offering corporate cards, bill payments, accounting automation, and spend management to save time and money.

Brex

A modern finance platform offering integrated corporate cards, expense management, and business banking solutions.

Emburse

Comprehensive cloud-based spend management platform streamlining expense, invoice, and corporate card processes with AI-enhanced automation and analytics.

Aspire

All-in-one AI-powered financial platform designed for modern businesses to manage multi-currency accounts, corporate cards, expenses, payments, and accounting automation.

DocuClipper

Professional OCR software for financial document data extraction with 99.6% accuracy and automated processing capabilities.

Alaan

AI-powered spend management platform offering instant corporate cards, automated expense tracking, and real-time financial control for businesses.

Zeni AI

AI-powered financial operations platform delivering automated bookkeeping, real-time insights, and expert financial support for startups and growing businesses.

Analytics of Peakflo Website

🇮🇩 ID: 46.45%

🇲🇾 MY: 13.59%

🇺🇸 US: 9.69%

🇮🇳 IN: 8.08%

🇻🇳 VN: 3.73%

Others: 18.45%