Ramp

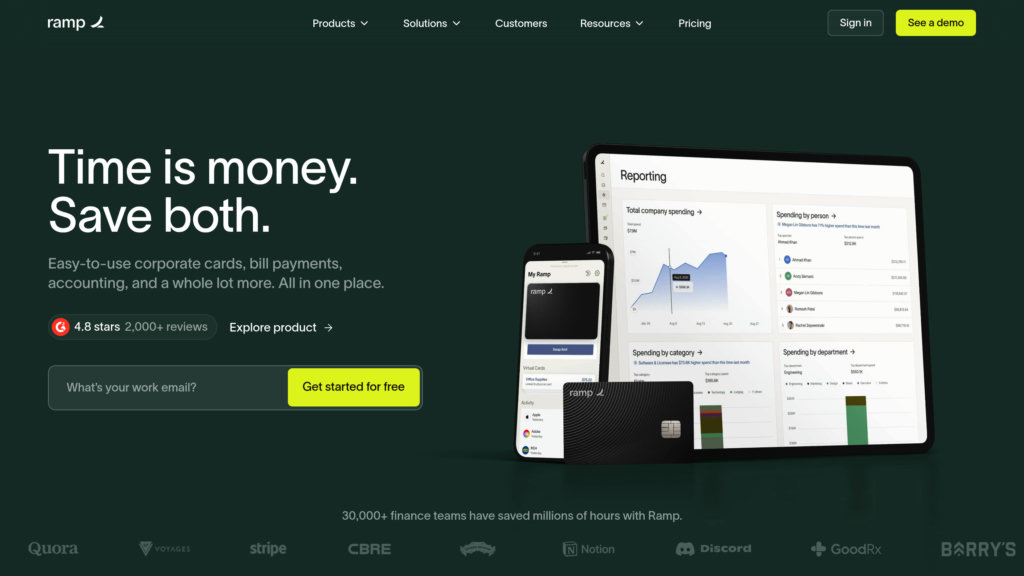

An all-in-one finance automation platform offering corporate cards, bill payments, accounting automation, and spend management to save time and money.

Community:

Product Overview

What is Ramp?

Ramp is a comprehensive financial operations platform designed to streamline corporate spend management by integrating expense management, procurement, accounting automation, and bill payments into a single intuitive system. It empowers finance teams to automate manual tasks such as transaction coding, invoice processing, and approval workflows, enabling faster month-end closes and improved financial visibility. Ramp supports seamless integration with popular accounting software and ERP systems, helping companies of all sizes reduce costs, enforce spending policies, and optimize vendor management.

Key Features

Corporate Card Management

Issue unlimited virtual and physical corporate cards with customizable spending limits and built-in controls to enforce company expense policies.

Automated Expense and Accounting

Automatically capture receipts, code transactions, and sync expenses in real time with accounting platforms like QuickBooks, NetSuite, and Xero to accelerate month-end closing.

Accounts Payable Automation

Leverage AI-powered invoice scanning, automated approval workflows, and batch payments to streamline invoice processing and reduce manual errors.

Procurement and Vendor Management

Centralize vendor onboarding, purchase orders, and contract pricing comparisons to control spend and improve procurement efficiency.

Travel Booking and Expense Integration

Book in-policy travel with zero fees, automate expense submissions during trips, and integrate travel expenses directly into Ramp’s platform.

Real-Time Spend Visibility and Controls

Gain actionable insights with real-time alerts, spending dashboards, and policy enforcement to prevent out-of-policy expenses and optimize budgets.

Use Cases

- Finance Team Efficiency : Automate manual accounting and AP tasks to close books faster and reduce reconciliation time, freeing finance teams to focus on strategic priorities.

- Expense Policy Enforcement : Set and enforce company spending policies automatically through card controls and approval workflows to prevent unauthorized expenses.

- Vendor and Invoice Management : Streamline vendor payments and invoice approvals with AI-driven automation, reducing late payments and improving vendor relationships.

- Travel and Expense Management : Simplify corporate travel booking and expense reporting with integrated tools that ensure compliance and automate receipt matching.

- Procurement Optimization : Manage purchase orders, approvals, and vendor contracts centrally to reduce costs and improve procurement transparency.

FAQs

Ramp Alternatives

Brex

A modern finance platform offering integrated corporate cards, expense management, and business banking solutions.

Aspire

All-in-one AI-powered financial platform designed for modern businesses to manage multi-currency accounts, corporate cards, expenses, payments, and accounting automation.

Jeeves

Unified financial platform enabling businesses to manage corporate cards, payments, and expenses across multiple countries and currencies.

Zeni AI

AI-powered financial operations platform delivering automated bookkeeping, real-time insights, and expert financial support for startups and growing businesses.

Monet

FinTech platform designed for creatives and freelancers to manage business finances and access instant payments.

Midday

An all-in-one business management platform designed for freelancers, contractors, and small business owners to streamline financial and administrative tasks with AI-powered assistance.

Client Hub

All-in-one practice management platform for accounting firms, streamlining workflows, secure client communication, and document sharing.

CarbonChain

CarbonChain provides precise carbon accounting software tailored for metals and energy supply chains, enabling companies to track, report, and reduce emissions effectively.

Analytics of Ramp Website

🇺🇸 US: 86.42%

🇺🇿 UZ: 1.53%

🇬🇧 GB: 1.34%

🇨🇦 CA: 1.32%

🇮🇳 IN: 1.07%

Others: 8.32%