IDWise

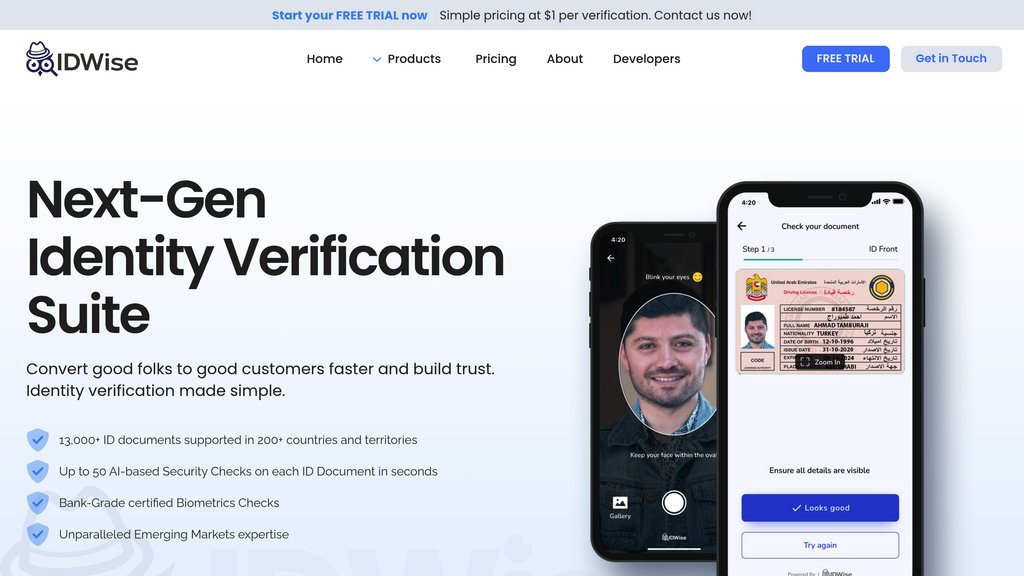

Enterprise-grade identity verification platform designed for complex and high-risk markets, enabling fast, accurate, and compliant customer onboarding.

Community:

Product Overview

What is IDWise?

IDWise delivers a comprehensive identity verification and fraud prevention solution tailored for emerging and high-complexity markets. It combines advanced document verification, facial biometrics, and behavioral analysis to ensure secure and seamless onboarding. The platform supports over 13,000 government-issued IDs from 190 countries, offering high accuracy and adaptability to diverse regulatory environments. With a no-code workflow builder and flexible deployment options, IDWise balances user experience, fraud prevention, and compliance, helping enterprises accelerate customer acquisition while maintaining trust and security.

Key Features

Extensive Document Verification

Validates a wide range of government-issued IDs globally with high precision, including support for diverse formats and scripts.

Advanced Facial Biometrics

Performs live selfie verification with liveness detection and face matching against ID photos to prevent spoofing and impersonation.

Behavioral and Device Intelligence

Analyzes user behavior and device data to detect anomalies and sophisticated fraud attempts beyond traditional checks.

No-Code Workflow Customization

Allows compliance and risk teams to tailor verification processes dynamically without engineering support, optimizing for speed, security, and regulatory compliance.

Local Data Residency and Compliance

Offers on-premise and in-country cloud deployments to meet strict data protection and regulatory requirements worldwide.

Seamless Integration and Scalability

Provides API access and flexible integration patterns to fit various business needs and scale efficiently.

Use Cases

- Financial Services Onboarding : Enables banks and fintechs to onboard customers rapidly while meeting KYC and AML regulations in complex markets.

- Telecommunications Customer Verification : Helps telecom providers verify subscriber identities securely to reduce fraud and comply with local regulations.

- Insurance Customer Validation : Facilitates fast and reliable identity checks for insurance providers to streamline policy issuance and claims.

- E-Commerce Fraud Prevention : Protects online retailers by verifying user identities and detecting fraudulent transactions during account creation.

- Regulatory Compliance for Enterprises : Supports enterprises in adhering to evolving global and local identity verification laws with adaptable workflows.

FAQs

IDWise Alternatives

OneSchema

A platform that automates CSV and file imports by simplifying mapping, validation, and transformation workflows for faster and error-free data integration.

ComplyCube

ComplyCube is a comprehensive compliance platform that streamlines identity verification, AML, and KYC processes with extensive global coverage and flexible integration options.

Onfido

AI-powered digital identity verification platform enabling secure, automated customer onboarding and fraud prevention.

Recruit CRM

AI-powered recruitment software combining ATS and CRM to automate hiring, enhance candidate sourcing, and streamline recruitment workflows.

Veriff

AI-powered identity verification platform ensuring fast, accurate, and secure onboarding worldwide.

Crikk

AI-powered text-to-speech platform offering highly realistic voiceovers in over 90 languages with extensive voice options and multi-format input support.

Popl

Digital business card platform with lead capture capabilities for seamless professional networking and contact management.

Parseur

AI-powered data extraction software that automates text parsing from emails, PDFs, spreadsheets, and documents with seamless integration to business applications.

Analytics of IDWise Website

🇮🇳 IN: 31.24%

🇺🇸 US: 26.6%

🇻🇳 VN: 14.14%

🇵🇰 PK: 9.85%

🇦🇪 AE: 7.07%

Others: 11.09%