ComplyCube

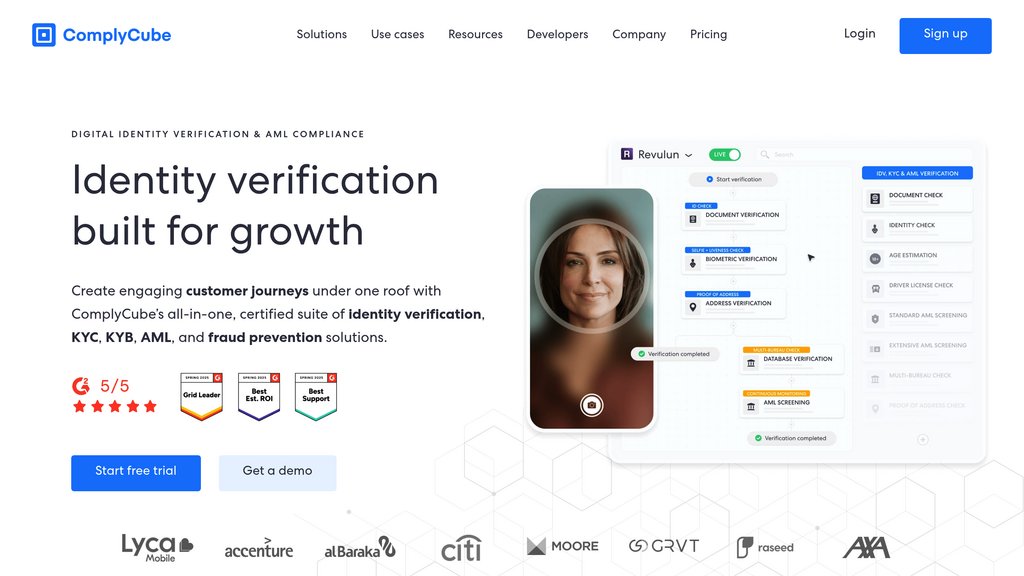

ComplyCube is a comprehensive compliance platform that streamlines identity verification, AML, and KYC processes with extensive global coverage and flexible integration options.

Community:

Product Overview

What is ComplyCube?

ComplyCube offers an all-in-one solution designed to help businesses of all sizes meet regulatory compliance requirements efficiently. It supports identity verification, Anti-Money Laundering (AML), and Know Your Customer (KYC) processes through a robust platform that covers over 220 countries and supports more than 10,000 document types. The platform features advanced biometric checks, continuous monitoring, and risk scoring to ensure secure customer onboarding and ongoing due diligence. With a range of integration methods including APIs, SDKs, and low-code/no-code options, ComplyCube adapts to various business models and industries such as fintech, telecoms, e-commerce, and healthcare.

Key Features

Extensive Global Coverage

Supports identity verification and AML compliance across 220+ countries with access to over 3,000 trusted data points and 10,000+ document types.

Advanced Biometric and Document Verification

Includes biometric checks, liveness detection, RFID validation, and smart data extraction to ensure the authenticity of customer identities.

Flexible Integration Options

Offers REST APIs, mobile and web SDKs, client libraries, and low/no-code solutions for fast and seamless integration into existing workflows.

Comprehensive AML and KYC Screening

Provides customer screening against sanctions, PEP lists, adverse media, and continuous monitoring to maintain compliance and mitigate risks.

Customizable and User-Friendly Onboarding

Delivers a smooth, guided verification experience with customizable workflows that reduce friction for genuine users while deterring fraud.

Use Cases

- Customer Onboarding : Streamline identity verification and compliance checks during user registration to ensure fast and secure onboarding.

- AML Compliance : Automate anti-money laundering screening and monitoring to meet regulatory obligations and prevent financial crime.

- Risk Management : Assess customer risk through proprietary scoring and ongoing due diligence to make informed business decisions.

- Fraud Prevention : Leverage biometric verification and document authentication to detect and prevent fraudulent activities.

- Regulatory Reporting : Generate detailed audit trails and compliance reports to satisfy regulators and support internal reviews.

FAQs

ComplyCube Alternatives

OneSchema

A platform that automates CSV and file imports by simplifying mapping, validation, and transformation workflows for faster and error-free data integration.

IDWise

Enterprise-grade identity verification platform designed for complex and high-risk markets, enabling fast, accurate, and compliant customer onboarding.

Onfido

AI-powered digital identity verification platform enabling secure, automated customer onboarding and fraud prevention.

Recruit CRM

AI-powered recruitment software combining ATS and CRM to automate hiring, enhance candidate sourcing, and streamline recruitment workflows.

Veriff

AI-powered identity verification platform ensuring fast, accurate, and secure onboarding worldwide.

Crikk

AI-powered text-to-speech platform offering highly realistic voiceovers in over 90 languages with extensive voice options and multi-format input support.

Popl

Digital business card platform with lead capture capabilities for seamless professional networking and contact management.

Parseur

AI-powered data extraction software that automates text parsing from emails, PDFs, spreadsheets, and documents with seamless integration to business applications.

Analytics of ComplyCube Website

🇬🇧 GB: 14.46%

🇮🇳 IN: 10.94%

🇿🇦 ZA: 8.98%

🇺🇸 US: 7.27%

🇳🇬 NG: 6.86%

Others: 51.49%