Frec

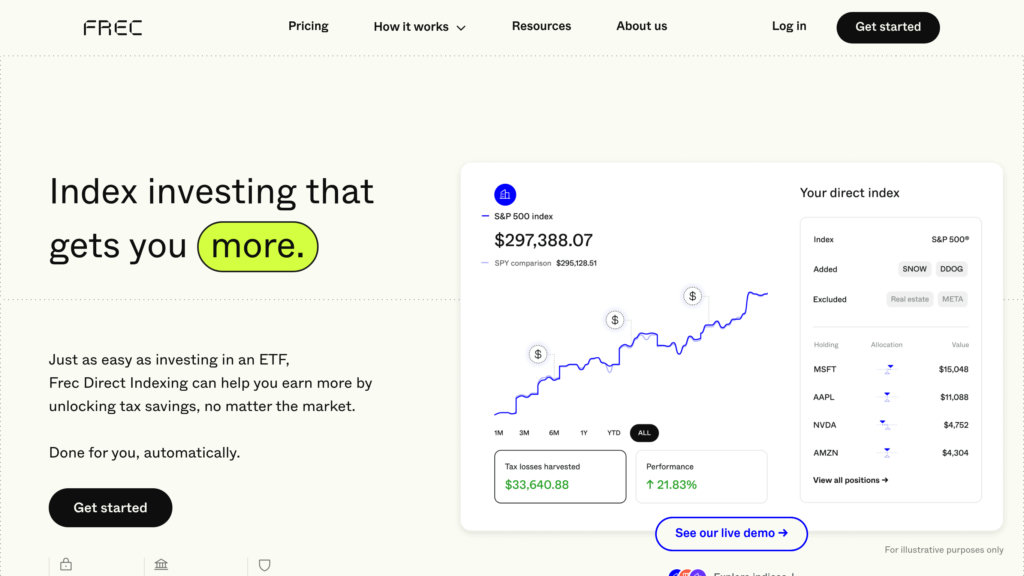

A direct indexing platform offering low-cost, customizable index investing with advanced daily tax-loss harvesting and portfolio credit lines.

Community:

Product Overview

What is Frec?

Frec is a modern investment platform that democratizes access to sophisticated direct indexing strategies traditionally reserved for high-net-worth investors. It enables users to own individual stocks within major indices like the S&P 500, providing enhanced tax efficiency through daily, algorithm-driven tax-loss harvesting at the individual stock level. Frec offers customizable portfolios with options to exclude or add stocks and sectors, all at a competitive flat advisory fee starting at 0.10%. Additional features include portfolio lines of credit and high-yield treasury cash management, empowering investors with more control, transparency, and cost-effective wealth management tools.

Key Features

100% Direct Indexing

Invest directly in individual stocks of major indices such as the S&P 500 with nearly all invested dollars indexed for maximum tax efficiency.

Advanced Daily Tax-Loss Harvesting

Utilizes cutting-edge algorithms and MSCI’s Barra Risk Model to identify daily tax-loss harvesting opportunities at the stock level, delivering up to twice the tax loss harvesting compared to ETF-level approaches.

Customizable Portfolios

Choose from 14 different indices and tailor your portfolio by excluding up to two sectors and adding or excluding individual stocks, with flexible dividend allocation options.

Low and Transparent Fees

Flat advisory fees starting at 0.10%, with no additional ETF expense ratios, making direct indexing affordable and transparent.

Portfolio Line of Credit

Access cash by borrowing against up to 70% of your portfolio at competitive rates without selling your investments.

High-Yield Treasury Cash Management

Earn competitive interest rates on idle cash with a highly liquid, low-risk treasury fund integrated into the platform.

Use Cases

- Tax-Efficient Investing : Investors seeking to reduce capital gains taxes through frequent, automated tax-loss harvesting at the individual stock level.

- Portfolio Customization : Investors wanting to tailor index exposure by excluding sectors or stocks that do not align with their values or investment goals.

- Cost-Conscious Investors : Individuals looking for low-fee direct indexing alternatives to traditional robo-advisors and wealth managers.

- Access to Liquidity : Investors needing flexible access to cash without liquidating assets via portfolio lines of credit.

- Cash Management : Users looking to maximize returns on idle cash with insured, high-yield treasury funds.

FAQs

Frec Alternatives

iNRI

AI-powered investment platform simplifying Indian mutual fund investments for NRIs with personalized portfolios and seamless compliance.

AInvest

Integrated AI-powered investment platform offering stock analysis, real-time market insights, and portfolio management for smarter trading.

StockStory

StockStory is a financial research platform that delivers in-depth stock analysis, market insights, and investment ideas focused on high-quality companies with strong fundamentals.

Keeper Tax

AI-powered tax filing and expense tracking software designed for freelancers, independent contractors, and small business owners to maximize deductions and simplify tax filing.

Danelfin

AI-powered stock analytics platform offering probabilistic stock rankings and portfolio optimization with explainable AI.

DealStream

AI-powered deal sourcing platform providing access to businesses, investment properties, and funding opportunities with personalized recommendations.

Accountable

All-in-one AI-powered finance app for self-employed professionals in Germany, covering bookkeeping, invoicing, banking, and taxes with guaranteed accuracy.

ANNA Money

AI-powered business account and tax app designed to simplify financial admin for small businesses and freelancers.

Analytics of Frec Website

🇺🇸 US: 98.9%

🇨🇦 CA: 0.8%

🇬🇧 GB: 0.29%

Others: 0%