Binocs

Portfolio monitoring and due diligence platform for private credit funds and alternative investors with automated document analysis.

Product Overview

What is Binocs?

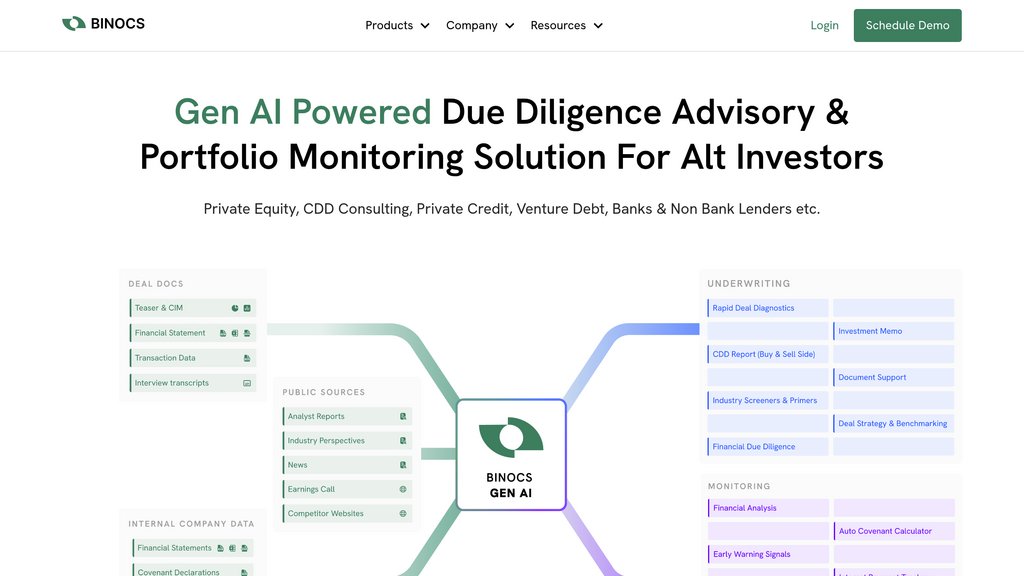

Binocs is a comprehensive portfolio tracking and workflow management system designed specifically for private credit funds, NBFCs, and alternative investors. The platform streamlines due diligence processes and portfolio monitoring through automated document analysis, real-time covenant tracking, and interest repayment monitoring. Built with LISA, their intelligent analysis agent, Binocs transforms unstructured financial data from diverse documents into actionable insights, enabling investment professionals to make faster, more informed decisions while improving operational efficiency and risk management.

Key Features

Automated Document Analysis

Intelligent extraction and standardization of financial data from diverse document formats, eliminating manual processing and reducing errors in financial analysis.

Real-time Covenant Tracking

Continuous monitoring of loan covenants and compliance requirements with automated alerts for potential breaches or violations.

LISA Analysis Agent

24/7 available intelligent agent that generates custom financial analysis and insights on-demand, providing instant access to portfolio intelligence.

Custom Financial Views

Standardized financial reporting in customizable formats with available templates to match specific organizational requirements and preferences.

Early Warning System

Advanced anomaly detection and financial health monitoring that identifies potential risks and issues before they become critical problems.

Use Cases

- Private Credit Fund Management : Portfolio managers can track loan performance, monitor covenant compliance, and assess borrower financial health across their entire investment portfolio.

- Due Diligence Automation : Investment teams can streamline deal screening with automated scoring on market attractiveness, financial metrics, and strategic fit assessment.

- NBFC Operations : Non-banking financial companies can automate loan monitoring, track repayments, and maintain compliance with regulatory requirements.

- Risk Management : Risk officers can leverage real-time monitoring and early warning signals to proactively identify and mitigate potential portfolio risks.

- Regulatory Compliance : Financial institutions can ensure adherence to regulatory requirements through automated reporting and continuous compliance monitoring.

FAQs

Binocs Alternatives

Unsiloed AI

Advanced platform for parsing multimodal unstructured documents into structured, actionable data using proprietary vision-language models and AI agents.

Fintelite AI

AI-driven financial intelligence platform automating data extraction, analysis, risk management, and personalized client engagement.

Finley

Comprehensive debt capital management software that centralizes, automates, and analyzes capital market operations for borrowers and lenders.

Revv Invest

A specialized stock search engine designed to simplify discovering and investing in frontier stocks like AI, space, and robotics.

Elicit

AI-powered research assistant that automates literature search, summarization, and data extraction from over 125 million academic papers.

Onfido

AI-powered digital identity verification platform enabling secure, automated customer onboarding and fraud prevention.

Analytics of Binocs Website

🇮🇳 IN: 98.87%

🇺🇸 US: 1.12%

Others: 0%