Bankjoy

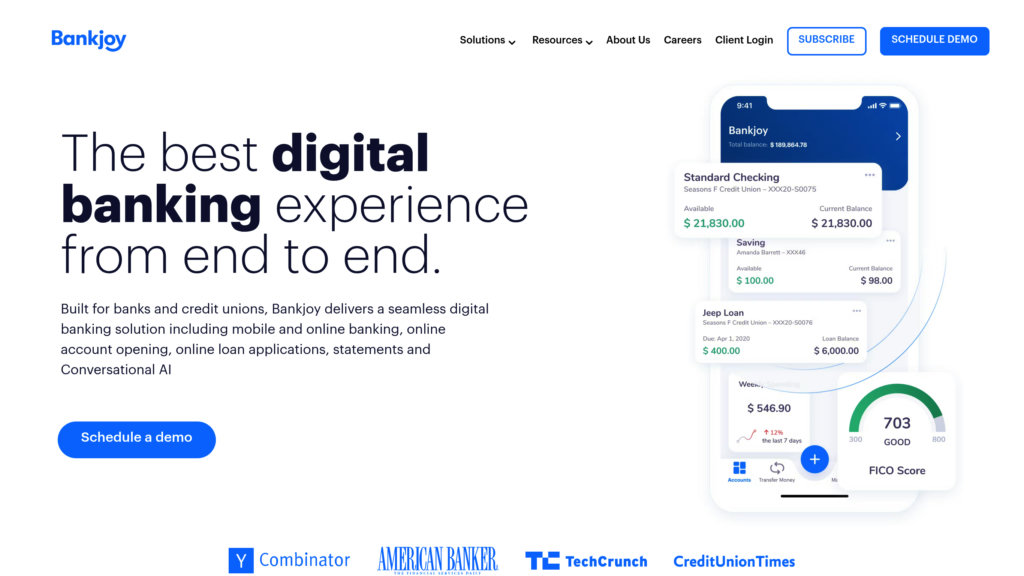

Comprehensive digital banking platform delivering seamless mobile and online banking, loan applications, account opening, and conversational AI for community banks and credit unions.

Community:

Product Overview

What is Bankjoy?

Bankjoy offers an integrated digital banking ecosystem tailored for banks and credit unions, focusing on delivering a smooth, modern user experience across retail and business banking. Its platform includes mobile and online banking, streamlined online account opening and loan applications, conversational AI, and enhanced security features. Designed to support community financial institutions, Bankjoy helps them grow deposits, improve member engagement, and provide financial wellness tools, all while maintaining strong security and fraud prevention.

Key Features

Unified Digital Banking Suite

Seamlessly integrated mobile and online banking platforms with consistent design and advanced features for retail and business customers.

Online Account Opening 2.0

Fast, secure, and customizable onboarding process with real-time ID verification and multiple core system integrations to reduce abandonment and accelerate deposit growth.

Business Banking 2.0

Enhanced platform for small and medium businesses featuring multi-account access, permission controls, bulk transfers, and integration with third-party services like QuickBooks.

Conversational AI and Phone Banking

Natural language interface accessible via phone, Amazon Alexa, and Google Home to assist customers with banking tasks and financial goals.

Robust Security and Fraud Prevention

Industry-leading security measures including multi-factor authentication, positive pay, real-time fraud monitoring, and risk checks to protect users and institutions.

Financial Wellness Platform – JoyCompass

Embedded personal finance tools that promote financial literacy and engagement, driving member adoption and supporting community bank missions.

Use Cases

- Retail Banking Experience : Provide consumers with a modern, mobile-first banking experience that includes account management, statements, and loan applications.

- Business Banking Management : Enable small and medium-sized businesses to efficiently manage multiple accounts, control user permissions, and process payments securely.

- Streamlined Account Onboarding : Accelerate new customer acquisition through a fast, secure, and user-friendly online account opening process.

- Customer Engagement via Conversational AI : Support customers with intuitive voice and chat banking services that simplify access to financial information and services.

- Financial Wellness and Growth : Help community banks increase member engagement and deposits with gamified financial education and wellness tools.

FAQs

Bankjoy Alternatives

Valora

Comprehensive platform for automating, consolidating, and analyzing financial data, purpose-built for FP&A teams.

Img2Sheet

Img2Sheet instantly extracts structured data from images and syncs it directly to Google Sheets, streamlining document management and eliminating manual data entry.

Best Budgeting Tool

A simple and intuitive platform for visualizing personal finances, tracking income and expenses, and planning for future goals.

Peek Money

A personal finance app designed to simplify money management by auto-tracking finances, providing personalized insights, and turning goals into actionable steps.

Skcript S1 EDGE

Enterprise-grade document data extraction platform designed to automate and scale data processing from diverse document types with high accuracy and security.

Merlin AI

AI-powered construction management platform delivering real-time insights, workflow automation, and financial oversight to optimize project outcomes.

Analytics of Bankjoy Website

🇺🇸 US: 65.15%

🇨🇦 CA: 32.95%

🇮🇳 IN: 1.88%

Others: 0.01%