Scalar Field

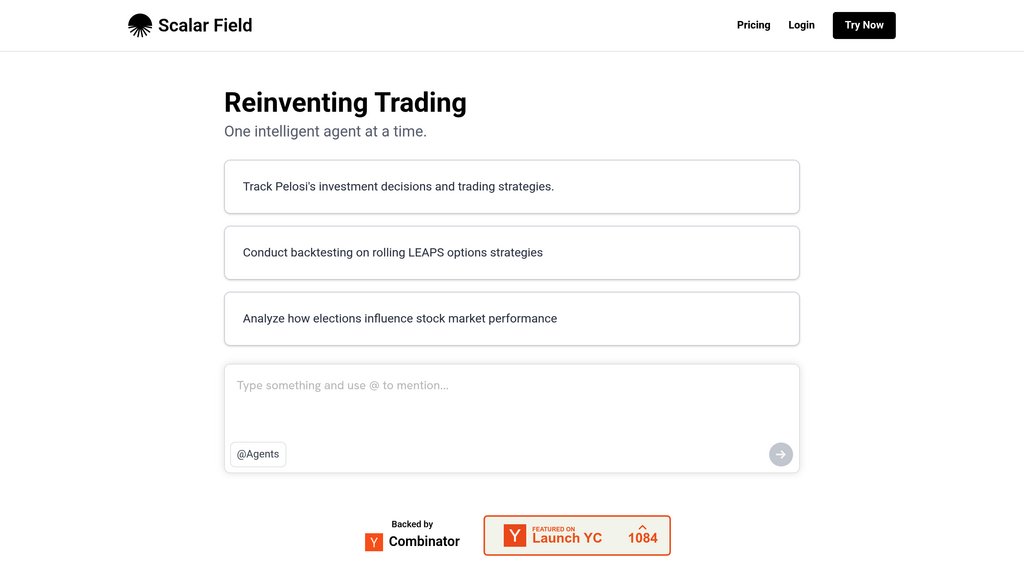

Intelligent trading terminal platform that enables hypothesis-driven market research and backtesting through natural language queries.

Community:

Product Overview

What is Scalar Field?

Scalar Field is a next-generation trading terminal that reimagines how traders and analysts conduct market research. Founded by former professionals from Tower Research, Goldman Sachs, and Microsoft, the platform transforms traditional dashboard-based terminals into an intelligent research assistant. Users can test market hypotheses instantly through natural language queries, access comprehensive historical options data, and run sophisticated backtests across multiple datasets including fundamentals, prices, macroeconomic data, and alternative data sources. The platform serves both retail traders and institutional clients, offering agent-driven insights that can react to live market changes and even initiate trades based on predefined criteria.

Key Features

Natural Language Market Research

Query comprehensive historical options data and market information using natural language, eliminating the need to navigate complex dashboard interfaces.

Intelligent Backtesting Engine

Run compute-heavy backtests across multiple datasets including fundamentals, pricing data, macroeconomic indicators, and alternative data sources.

Adaptive Agent System

Deploy intelligent agents that reorganize dashboards based on new market signals, events, and changing conditions in real-time.

Persistent Research Memory

Maintain continuous research trails across sessions, ensuring no insights or analysis work is lost between trading sessions.

Multi-Hop Workflow Automation

Chain complex analytical workflows that can trigger actions based on multiple market conditions and criteria simultaneously.

Use Cases

- Options Trading Research : Analyze historical options data with Greeks calculations, pricing trends, and contract filtering for informed options trading decisions.

- Hypothesis Testing : Validate trading theories and market hypotheses through comprehensive backtesting and data analysis across multiple timeframes.

- Algorithmic Trading Development : Build and test automated trading strategies that can react to live market changes and execute trades based on predefined conditions.

- Institutional Research : Conduct deep market analysis combining fundamentals, technical indicators, and macroeconomic data for institutional investment decisions.

- Risk Management : Monitor portfolio risk through real-time analysis of Greeks, market correlations, and exposure across different asset classes.

FAQs

Scalar Field Alternatives

CoinScreener

Comprehensive crypto trading platform offering real-time market signals, whale tracking, and top trader alerts to enhance trading decisions.

Infinity AI

A versatile AI platform integrating NLP, machine learning, and advanced automation to empower crypto trading, marketing, and content creation through conversational AI and no-code tools.

Moontower AI

Advanced options analytics platform offering comprehensive volatility insights and AI-powered trading assistance across multiple asset classes.

AI-Signals

AI-powered trading indicator delivering real-time buy/sell signals, market insights, and advanced tools for stocks, forex, and crypto on TradingView.

GoMoon.ai

Smart economic calendar for traders, offering real-time event tracking, impact analysis, and personalized alerts to support informed market decisions.

MySports AI

AI-powered sports betting platform delivering data-driven predictions and strategic betting insights across multiple sports and sportsbooks.

Drip Capital

Technology-driven trade finance platform providing working capital solutions tailored for SMEs engaged in cross-border trade.

Cheddar Flow

Real-time options order flow platform providing institutional activity insights, unusual options alerts, and AI-powered trading signals.

Analytics of Scalar Field Website

🇮🇳 IN: 56.07%

🇺🇸 US: 38.22%

🇬🇧 GB: 4.4%

🇨🇦 CA: 0.95%

🇫🇷 FR: 0.33%

Others: 0.03%