Drip Capital

Technology-driven trade finance platform providing working capital solutions tailored for SMEs engaged in cross-border trade.

Community:

Product Overview

What is Drip Capital?

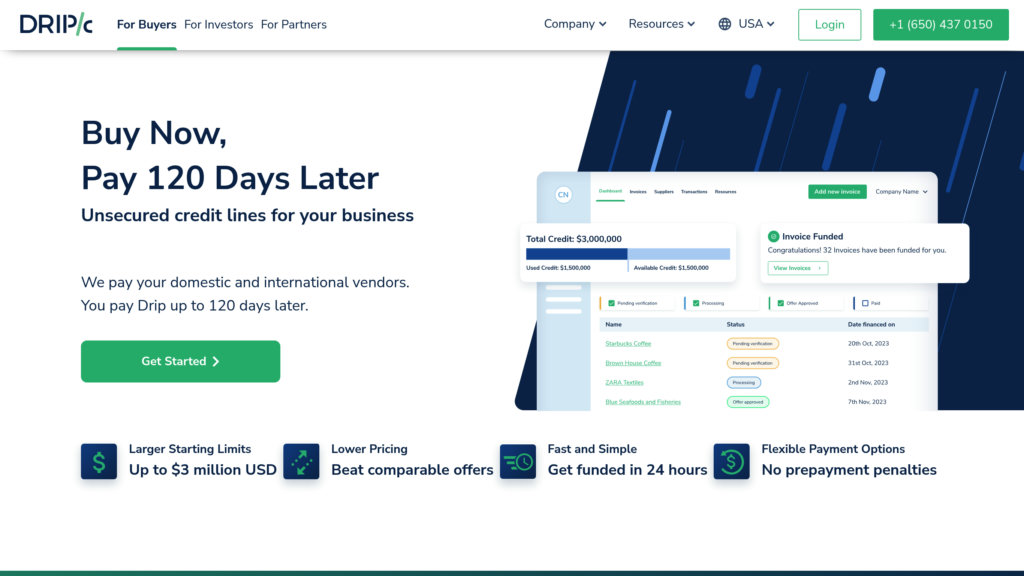

Drip Capital is a fintech company specializing in digital trade finance solutions for small and medium-sized enterprises (SMEs) involved in international trade, primarily in the US, India, and Mexico. By leveraging advanced technology, data analytics, and automated risk management, Drip Capital offers flexible, collateral-free financing options such as supply chain finance, invoice discounting, and buyer financing. These solutions help businesses optimize cash flow, extend payment terms, and scale operations efficiently while mitigating currency risks and accelerating supplier payments.

Key Features

Fast Funding and Disbursement

Access funds within 24 to 48 hours after application, enabling quick supplier payments and improved cash flow.

Flexible Repayment Terms

Offers repayment periods up to 120 days with no prepayment penalties, allowing businesses to manage working capital effectively.

Collateral-Free Financing

No requirement for physical asset collateral; financing is secured against invoices, making it accessible to asset-light businesses.

Technology-Driven Credit Assessment

Utilizes proprietary data analytics and automated risk systems to evaluate creditworthiness and reduce default risk.

Multi-Currency Payments

Supports supplier payments in various currencies to hedge against foreign exchange risks.

Dedicated Customer Support

Provides personalized account management and credit support to ensure smooth financing processes.

Use Cases

- Working Capital Optimization : SMEs can bridge cash flow gaps by financing invoices and extending payment terms without disrupting operations.

- Supply Chain Finance : Buyers can pay suppliers promptly while deferring their own payments, maintaining a healthy supply chain ecosystem.

- International Trade Expansion : Enables importers and exporters to access capital for scaling cross-border trade with flexible and fast financing.

- Invoice Discounting : Businesses can unlock cash tied up in unpaid invoices to fund operational expenses or growth initiatives.

- Risk Mitigation : Helps manage currency and credit risks through technology-enabled financing and multi-currency support.

FAQs

Drip Capital Alternatives

Cheddar Flow

Real-time options order flow platform providing institutional activity insights, unusual options alerts, and AI-powered trading signals.

MySports AI

AI-powered sports betting platform delivering data-driven predictions and strategic betting insights across multiple sports and sportsbooks.

GoMoon.ai

Smart economic calendar for traders, offering real-time event tracking, impact analysis, and personalized alerts to support informed market decisions.

AI-Signals

AI-powered trading indicator delivering real-time buy/sell signals, market insights, and advanced tools for stocks, forex, and crypto on TradingView.

Moontower AI

Advanced options analytics platform offering comprehensive volatility insights and AI-powered trading assistance across multiple asset classes.

Misprint

A marketplace for buying and selling graded trading cards with real-time pricing analytics and a transparent bid/ask system.

CoinScreener

Comprehensive crypto trading platform offering real-time market signals, whale tracking, and top trader alerts to enhance trading decisions.

Scalar Field

Intelligent trading terminal platform that enables hypothesis-driven market research and backtesting through natural language queries.

Analytics of Drip Capital Website

🇮🇳 IN: 40.38%

🇺🇸 US: 9.49%

🇲🇽 MX: 6.08%

🇳🇬 NG: 2.62%

🇬🇹 GT: 2.56%

Others: 38.86%