Jump

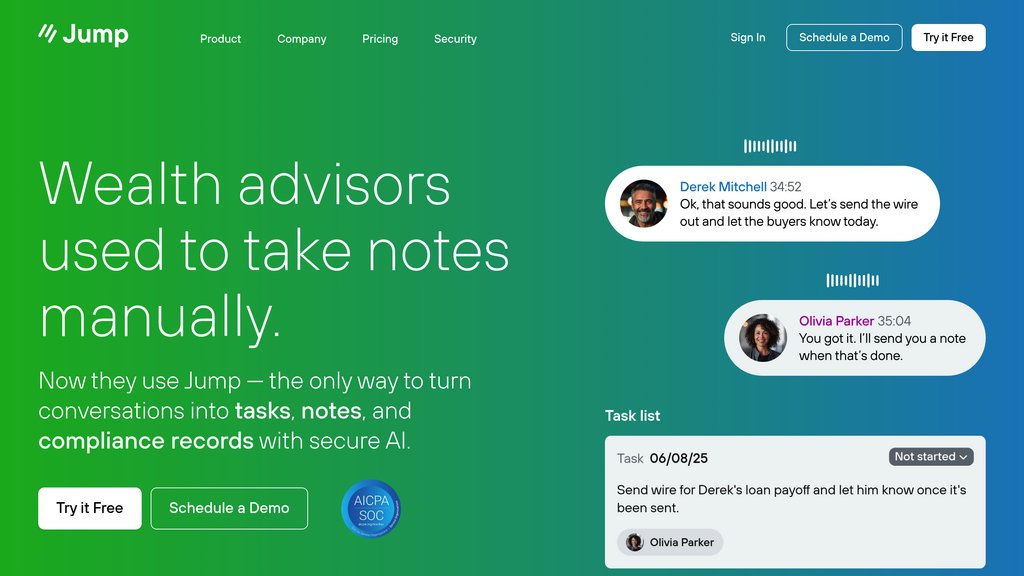

Meeting assistant platform designed exclusively for financial advisors to automate post-meeting tasks and reduce administrative time by 90%.

Community:

Product Overview

What is Jump?

Jump is a specialized meeting assistant platform built specifically for financial advisors and wealth management professionals. Unlike generic meeting summarizers, Jump offers deep integration with advisor-specific CRM systems like Salesforce, Redtail, and Wealthbox, transforming meeting conversations into customized notes, actionable tasks, and compliance records. The platform supports both virtual and in-person meetings through various capture methods, including desktop applications and mobile apps. Jump's core value proposition centers on reducing meeting-related administrative work from 60 minutes to just 5 minutes while maintaining compliance standards and improving client experience.

Key Features

Advisor-Specific Meeting Notes

Generates fully customizable meeting summaries that match individual advisor styles and formats, with the ability to extract financial data into structured tables and compliance-ready documentation.

Deep CRM Integration

One-click synchronization with major advisor CRM platforms including Salesforce, Redtail, and Wealthbox, automatically transferring notes, tasks, and client data without manual input.

Smart Task Management

Creates intelligent task objects with titles, descriptions, assignees, and due dates that sync directly into CRM systems, going beyond simple bullet-point action items.

Pre-Meeting Preparation

Automatically generates customizable one-page briefs before meetings by pulling client data from CRM and past meeting history, including conversation starters and task reminders.

Client Communication Automation

Produces ready-to-send follow-up emails within seconds of meeting completion, fully customizable to match advisor tone and style preferences.

Use Cases

- Client Meeting Documentation : Financial advisors can automatically generate compliant meeting notes and summaries for client consultations, reducing post-meeting administrative time significantly.

- Compliance Record Keeping : Wealth management firms can maintain detailed, searchable records of all client interactions for regulatory compliance and audit purposes.

- Client Relationship Management : Advisors can enhance client experience through timely follow-up communications and comprehensive meeting preparation using historical client data.

- Task and Workflow Automation : Financial planning teams can streamline post-meeting workflows by automatically generating and assigning tasks with proper context and deadlines.

- Multi-Location Meeting Capture : Advisory practices can capture and process both virtual meetings through platforms like Zoom and Teams, as well as in-person meetings using mobile applications.

FAQs

Jump Alternatives

Zoom

Comprehensive video communication platform enabling meetings, webinars, chat, phone, and collaboration tools for seamless virtual interaction.

Hoop

AI-powered task manager that automatically captures and centralizes tasks from meetings, Slack, and email for busy professionals.

MeetMinutes

AI-powered meeting assistant that transcribes, summarizes, and manages multilingual meetings with seamless integrations.

Amurex

Open-source AI meeting copilot and workflow companion that organizes knowledge, transcribes meetings, and automates task management seamlessly.

ClickMeeting

Browser-based webinar and virtual events platform offering live, automated, and on-demand event hosting with monetization capabilities and comprehensive engagement tools.

Slack

AI-powered collaboration platform uniting messaging, apps, and workflows to streamline team communication and productivity.

DingTalk

An all-in-one enterprise communication and collaboration platform by Alibaba, integrating messaging, video conferencing, project management, and AI-powered productivity tools.

Whereby

Browser-based video conferencing platform enabling instant video calls and customizable video integration with screen sharing, collaboration tools, and enterprise-grade security.

Analytics of Jump Website

🇺🇸 US: 99.11%

🇮🇳 IN: 0.39%

🇨🇦 CA: 0.35%

🇮🇩 ID: 0.13%

Others: 0.02%