Hadrius

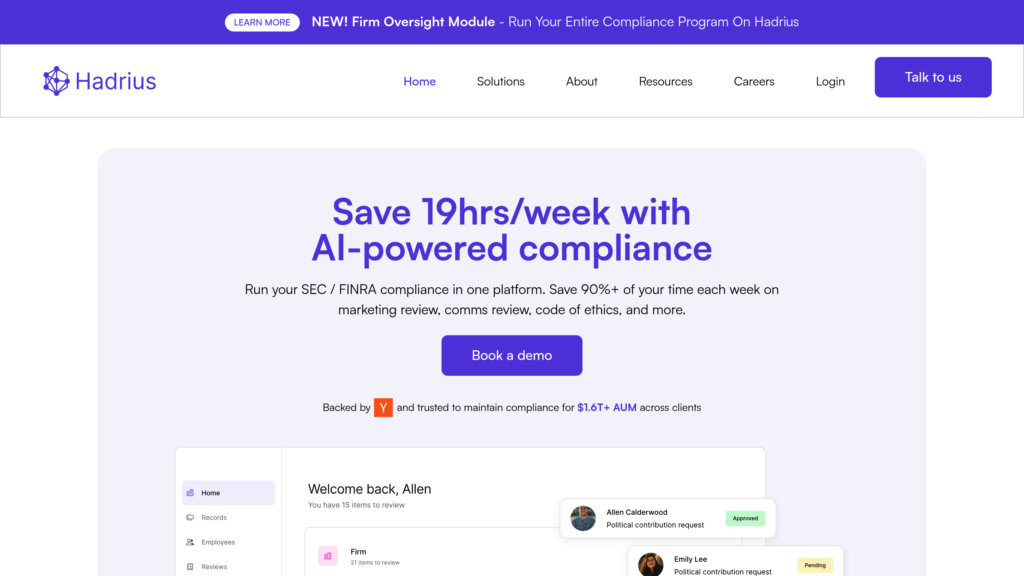

AI-powered compliance platform streamlining SEC and FINRA regulatory adherence for financial firms with automation and centralized oversight.

Community:

Product Overview

What is Hadrius?

Hadrius is an advanced AI-driven compliance software suite tailored for financial services firms such as investment managers, broker-dealers, and insurance companies. It automates and consolidates compliance workflows including communications archiving, marketing material review, trade monitoring, and firm-wide oversight. By leveraging AI, Hadrius reduces manual effort, cuts false positives in compliance reviews by over 90%, and accelerates regulatory adherence. The platform offers a unified dashboard that empowers compliance teams to efficiently manage tasks, maintain control, and demonstrate compliance with evolving regulations like SEC Rule 206(4)-7 and FINRA rules. Hadrius is SOC 2 compliant and regularly audited, ensuring robust security and privacy.

Key Features

Comprehensive Compliance Automation

Automates review and archiving of emails, social media, SMS, marketing materials, and employee activities to ensure regulatory compliance across multiple channels.

AI-Driven Communications Review

Utilizes advanced AI to drastically reduce false positives and speed up detection of non-compliant language in electronic communications.

Marketing Compliance and Archiving

AI-powered marketing review cuts compliance review time by up to 70%, enabling rapid approval and secure archiving of marketing content.

Firm-Wide Oversight and Task Management

Centralizes tracking of compliance tasks, attestations, disclosures, and reporting to reduce administrative burden and enhance governance.

Secure and Audited Infrastructure

SOC 2 compliant platform with regular third-party audits to ensure data security and privacy for sensitive compliance information.

Customizable and Scalable

Tailors AI models and workflows to fit specific firm compliance manuals and scales to accommodate firms of all sizes.

Use Cases

- Investment Management Compliance : Investment firms automate SEC-required reviews and filings, reducing manual work and mitigating regulatory risks.

- Broker-Dealer Regulatory Oversight : Broker-dealers streamline communications monitoring, trade surveillance, and employee compliance with AI-powered automation.

- Marketing Material Review : Marketing teams accelerate compliance approvals for campaigns, social media, and promotional content with AI-assisted reviews.

- Firm-Wide Compliance Governance : Compliance officers gain centralized control over firm policies, attestations, and risk management through a unified platform.

- Social Media and Electronic Communications Archiving : Ensures all digital communications are securely archived and easily retrievable for audits and regulatory examinations.

FAQs

Hadrius Alternatives

iCustoms

Comprehensive trade compliance platform automating customs declarations and product classification to accelerate clearance and reduce costs.

Pibit.ai

Platform transforming complex insurance documents into structured reports to enhance underwriting efficiency and decision accuracy.

Addy AI

AI-driven mortgage lending automation platform that accelerates loan origination by automating document processing, client communication, and data extraction.

Lucite

Automation platform for insurance, finance, and professional services that transforms complex documents into structured data, insights, and polished deliverables.

FurtherAI

AI-powered automation platform tailored for commercial insurance to streamline complex workflows and enhance operational efficiency.

Kaagaz Scanner

A free, ad-free Indian document scanning and PDF management app offering offline scanning, PDF editing, and secure cloud storage.

KYC Hub

Comprehensive compliance automation platform delivering fast, accurate identity verification and risk management across global markets.

Tap Mobile

A suite of mobile apps leveraging advanced technologies to simplify document management, photo editing, call recording, and caller identification.

Analytics of Hadrius Website

🇺🇸 US: 98.16%

🇬🇧 GB: 1.01%

🇮🇳 IN: 0.82%

Others: 0.01%