FurtherAI

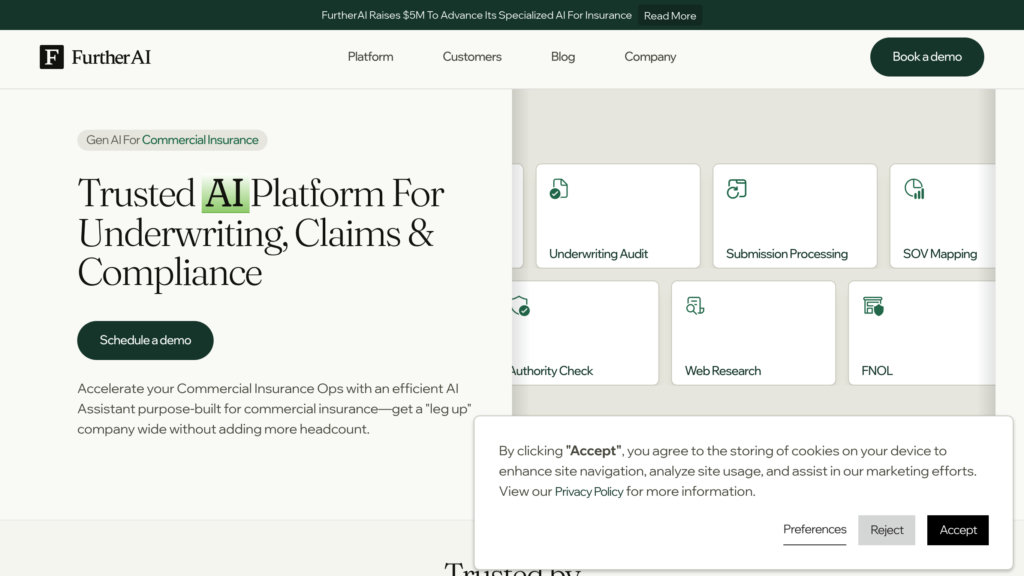

AI-powered automation platform tailored for commercial insurance to streamline complex workflows and enhance operational efficiency.

Community:

Product Overview

What is FurtherAI?

FurtherAI is a specialized AI platform designed exclusively for the commercial insurance sector. It automates intricate workflows such as submission intake, policy comparison, underwriting audits, and compliance checks, integrating fragmented systems to boost accuracy and speed. By leveraging advanced language models, FurtherAI significantly reduces manual, repetitive tasks—accelerating processes like client intake by up to 30 times and delivering ROI improvements up to 400%. Trusted by major MGAs, risk exchanges, and insurtechs, FurtherAI enables insurance teams to focus on strategic decision-making while maintaining high standards of compliance and privacy.

Key Features

Industry-Specific AI Assistant

Purpose-built AI designed to handle commercial insurance workflows including document processing, policy reviews, and underwriting tasks.

Automated Document Handling

Extracts key data, performs eligibility checks, and flags inconsistencies to accelerate client intake and policy processing.

Policy Comparison & Compliance

Delivers detailed side-by-side policy comparisons and automates compliance audits to ensure accuracy and regulatory adherence.

Seamless System Integration

Integrates with existing legacy systems and workflows, enabling scalable adoption without disrupting current operations.

High Accuracy and Efficiency

Achieves 95–97% accuracy in document and data processing, substantially outperforming manual methods.

Scalable Automation

Modular platform adaptable to various insurance processes, supporting growth and operational scaling.

Use Cases

- Underwriting Productivity : Doubles underwriting throughput by automating submission intake and data extraction.

- Compliance and Audit Efficiency : Reduces compliance audit times by over 20%, ensuring faster and more accurate regulatory checks.

- Policy Management : Simplifies policy comparison and review processes, helping brokers and insurers highlight competitive advantages.

- Claims and Risk Operations : Automates claims validation and risk evaluation tasks to speed decision-making and reduce manual errors.

- Customer Service Automation : AI-driven voice calling and portal navigation improve client interactions and operational responsiveness.

FAQs

FurtherAI Alternatives

Kaagaz Scanner

A free, ad-free Indian document scanning and PDF management app offering offline scanning, PDF editing, and secure cloud storage.

Hadrius

AI-powered compliance platform streamlining SEC and FINRA regulatory adherence for financial firms with automation and centralized oversight.

iCustoms

Comprehensive trade compliance platform automating customs declarations and product classification to accelerate clearance and reduce costs.

Pibit.ai

Platform transforming complex insurance documents into structured reports to enhance underwriting efficiency and decision accuracy.

KYC Hub

Comprehensive compliance automation platform delivering fast, accurate identity verification and risk management across global markets.

Addy AI

AI-driven mortgage lending automation platform that accelerates loan origination by automating document processing, client communication, and data extraction.

Lucite

Automation platform for insurance, finance, and professional services that transforms complex documents into structured data, insights, and polished deliverables.

Tap Mobile

A suite of mobile apps leveraging advanced technologies to simplify document management, photo editing, call recording, and caller identification.

Analytics of FurtherAI Website

🇺🇸 US: 70.03%

🇮🇳 IN: 23.24%

🇦🇪 AE: 4.59%

🇬🇧 GB: 2.12%

Others: 0.01%