Complif

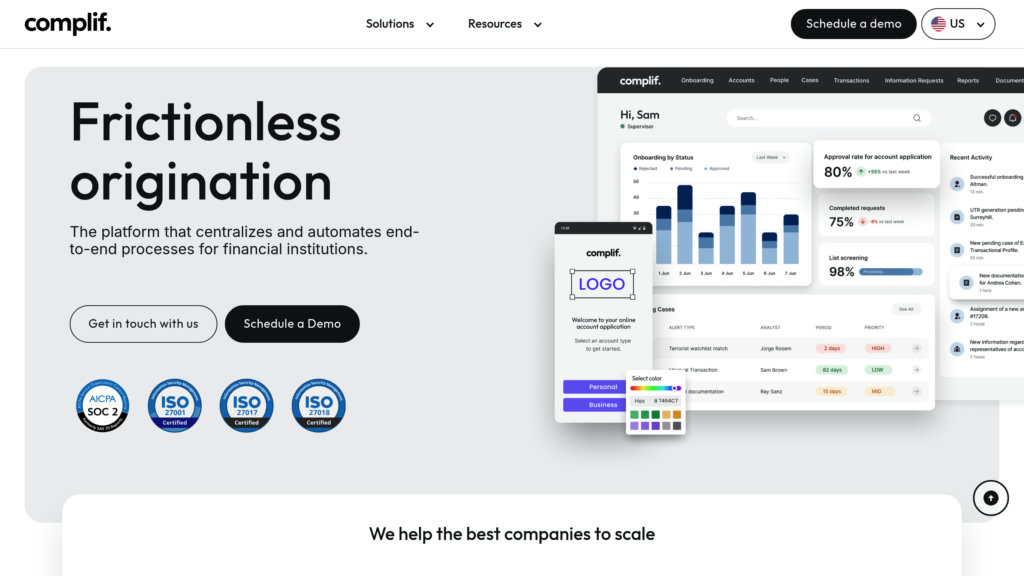

Comprehensive compliance automation platform designed for financial institutions to streamline KYC, AML, onboarding, and risk management processes.

Community:

Product Overview

What is Complif?

Complif is an advanced compliance software platform tailored for banks, fintechs, and financial institutions to automate and centralize regulatory compliance workflows. It integrates OCR technology, AI-driven risk assessments, and real-time monitoring to optimize customer onboarding, KYC/AML reviews, transaction monitoring, and case management. Complif supports multi-entity and multi-currency operations and offers a marketplace for plug-and-play integrations, enabling seamless connectivity with third-party data sources and applications. By unifying compliance processes into a single platform, Complif enhances operational efficiency, reduces manual workload, and ensures adherence to global regulatory standards.

Key Features

Automated Customer Onboarding

Fully digital onboarding with biometric identity validation, real-time document approval using OCR, and automatic data extraction to accelerate account opening and improve user experience.

End-to-End Compliance Management

Centralizes KYC, KYB, transaction monitoring, risk matrix calculation, and case management to streamline regulatory workflows and reduce operational risks.

AI-Powered Risk and Transaction Monitoring

Leverages AI algorithms for real-time risk assessment, automated adverse media screening, and customized alert generation to detect suspicious activities efficiently.

Plug & Play Integration Marketplace

Offers seamless integration with multiple external data providers and applications, automating data enrichment, sanction screening, and document verification.

Multi-Entity and Multi-Currency Support

Supports complex financial operations across various countries and currencies, consolidating financial and compliance data into a unified view.

Automated Periodic Reviews and Follow-ups

Automatically manages periodic KYC and compliance updates with configurable reminders and notifications, ensuring ongoing regulatory adherence.

Use Cases

- Financial Institution Compliance : Banks and fintechs use Complif to automate KYC/KYB, AML transaction monitoring, and regulatory reporting, reducing manual workload and compliance risks.

- Customer Onboarding Acceleration : Complif enables rapid, fully digital onboarding with biometric verification and instant document validation, improving customer conversion rates.

- Risk Management and Fraud Detection : AI-driven risk scoring and real-time alerting help compliance teams identify and act on suspicious transactions and adverse media efficiently.

- Multi-Jurisdictional Operations : Supports financial entities operating across different countries and currencies by consolidating compliance data and automating complex workflows.

- Compliance Case Management : Centralizes investigation workflows, evidence generation, and audit trails to ensure thorough case handling and regulatory readiness.

FAQs

Complif Alternatives

Ottimate

AI-powered accounts payable automation platform that streamlines invoice processing from capture to payment with deep ERP integration and smart workflow customization.

Skwad

Privacy-first budgeting app that tracks spending and manages finances using bank email alerts without requiring bank login credentials.

Evolution AI

Advanced data extraction platform that processes complex documents rapidly and accurately with minimal setup.

Tyms

AI-powered accounting software automating financial operations for modern businesses, enhancing efficiency and accuracy.

Routable

Comprehensive accounts payable automation platform that streamlines invoice processing, payment workflows, and vendor management for modern businesses.

AlgoDocs

A versatile document processing platform that automates accurate data extraction from various document types with seamless integrations.

cc:Monet

AI-driven financial management platform automating bookkeeping, expense tracking, and data insights for SMBs worldwide.

StatementSheet

Effortless bank statement converter that transforms PDF statements into Excel and CSV formats with high accuracy and global bank support.

Analytics of Complif Website

🇦🇷 AR: 54.99%

🇺🇸 US: 15.39%

🇨🇴 CO: 11.92%

🇲🇽 MX: 10.69%

🇪🇸 ES: 5.55%

Others: 1.46%