Balance

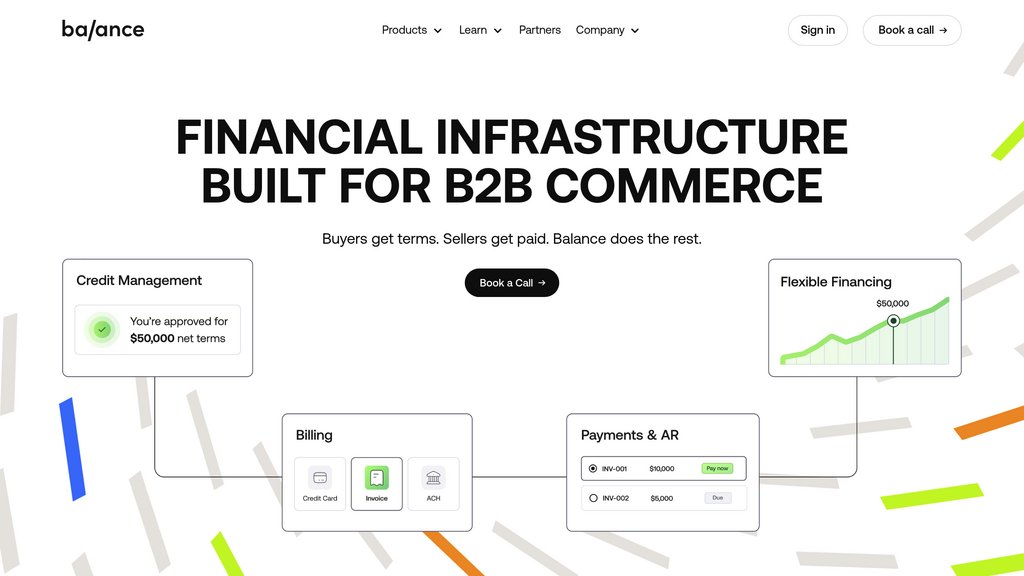

Comprehensive platform streamlining B2B transactions with integrated payment methods, financing, invoicing, and marketplace management.

Product Overview

What is Balance?

Balance is an end-to-end B2B transaction platform designed to simplify and optimize the entire payment lifecycle for businesses. It offers solutions that enable instant buyer approval for credit terms, flexible financing, multi-channel payment acceptance, and advanced accounts receivable automation. The platform supports seamless integration through robust APIs and provides a consumer-grade checkout experience tailored for B2B buyers worldwide. Balance’s tools help businesses grow sales, guarantee cash flow, reduce bad debt, and eliminate accounts receivable complexity, making it a trusted choice for marketplaces, procurement platforms, and enterprises.

Key Features

Dynamic Net Terms and Financing

Instant credit approval and flexible financing options that allow businesses to offer payment terms while receiving payments immediately, reducing risk and improving cash flow.

Multi-Method Payment Processing

Supports various payment channels consolidated into a single payout, enabling global transactions in local currencies with a streamlined checkout experience.

Advanced Invoicing and AR Automation

Self-serve invoicing with precise billing for partial shipments and backorders, automated matching of payments to invoices, and tools to reduce days sales outstanding (DSO).

Marketplace Operating System

Comprehensive suite for marketplaces and platforms to manage payouts, financing, and multi-party payments efficiently with customizable workflows.

Simple Integration and Customization

API-first design with expert support enables fast implementation and the ability to tailor buyer journeys with white-label or Balance branding.

Robust Reporting and Analytics

Dashboard reports provide visibility into financial data such as account activity, balance summaries, and unreconciled funds to support better decision-making.

Use Cases

- B2B Sales Growth : Enable businesses to expand sales by offering flexible payment terms and financing options that improve buyer purchasing power.

- Accounts Receivable Management : Finance teams can automate credit approvals, invoice reconciliation, and collections to reduce administrative burden and improve cash flow.

- Marketplace Payment Solutions : Marketplaces and platforms can streamline multi-party payments, manage payouts, and scale transaction volumes with integrated financing and payment tools.

- Global B2B Transactions : Support international business by accepting payments in local currencies and enabling cross-border financing and settlements.

- Order and Inventory Management : Handle complex invoicing scenarios such as backorders and partial shipments with precise billing and clear communication.

FAQs

Balance Alternatives

Glimpse

Automated platform for managing, categorizing, and disputing retail deductions, streamlining reconciliation for CPG brands.

Karbon Business

Karbon Business is a fintech platform offering corporate cards, automated vendor payments, and fast international remittance services for Indian businesses.

Mesha

AI-powered platform automating invoicing, payment follow-ups, bookkeeping, and marketing to boost business efficiency and revenue.

Parker

Comprehensive financial platform tailored for eCommerce businesses, combining banking, credit, and analytics to optimize cash flow and profitability.

QuickAds

Comprehensive ad creation platform that generates image and video advertisements using templates, competitor analysis, and automated publishing tools.

潮际好麦

AI-powered platform revolutionizing shoe and apparel design with flexible creativity and streamlined fashion manufacturing workflows.

Analytics of Balance Website

🇺🇸 US: 66.26%

🇮🇱 IL: 6.55%

🇨🇦 CA: 5.3%

🇻🇳 VN: 5.22%

🇳🇬 NG: 4.08%

Others: 12.59%