Value Sense

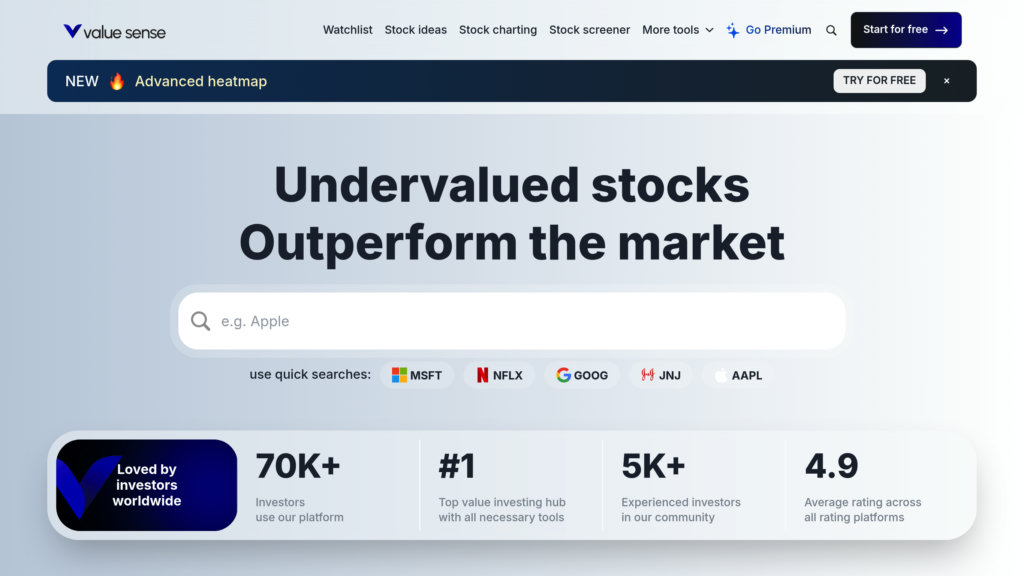

AI-powered platform for automated fundamental stock analysis, intrinsic value calculation, and investment insights.

Community:

Product Overview

What is Value Sense?

Value Sense is an intelligent investing platform that automates fundamental analysis using machine learning to process financial data and generate comprehensive reports. It offers intrinsic value calculators, company quality scoring, AI-generated earnings summaries, backtested investment strategies, and a powerful stock screener. Designed for investors of all levels, Value Sense simplifies complex financial concepts and provides actionable insights to identify undervalued stocks and make informed long-term investment decisions.

Key Features

Automated Fundamental Analysis

Leverages machine learning to analyze financial statements, calculate intrinsic values, and generate detailed company reports.

AI-Generated Earnings Summaries

Uses natural language generation to synthesize earnings calls into concise, insightful summaries highlighting key points.

Stock Charting and Visualization

Offers free, high-quality, institutional-grade charting tools to visualize financial metrics and compare stocks without paywalls.

Backtesting Investment Strategies

Allows users to simulate stock performance using historical data to evaluate risk and profitability before investing.

Comprehensive Stock Screener

Filters over 4,000 financial metrics to help users find stocks matching custom criteria and build personalized analysis formulas.

Company Quality Scoring

Provides instant insights into company quality through smart scoring and easy-to-understand analysis.

Undervalued Stock Ideas

Curated lists of undervalued and high-quality stocks to help investors discover market opportunities.

Use Cases

- Value Investing : Identify undervalued stocks using intrinsic value calculations and fundamental analysis for long-term wealth building.

- Investment Research : Save time with automated financial data analysis, AI earnings summaries, and comprehensive stock screening.

- Strategy Testing : Backtest investment strategies with historical data to assess potential risks and returns before committing capital.

- Portfolio Management : Use company scoring and detailed reports to monitor and optimize investment portfolios.

FAQs

Value Sense Alternatives

Gainium

AI-powered crypto trading platform offering automated bots, backtesting, multi-exchange integration, and advanced risk management.

DipSway

Automated crypto trading platform offering zero-configuration bots that execute trades 24/7 with advanced market analysis.

IntoTheBlock

AI-powered crypto analytics platform delivering actionable insights through advanced machine learning and on-chain data analysis.

Quantum AI

An advanced trading platform combining quantum computing and artificial intelligence to deliver fast, precise market analysis and automated trading.

Growlonix

AI-powered crypto trading platform offering advanced bots, multi-exchange integration, and customizable strategies for optimized automated trading.

PAX Markets

Ultra-low latency cryptocurrency exchange offering zero-fee trading, cash-back rebates, and a patented λ API for instant order placement.

Uptrends.ai

AI-powered stock market monitoring tool delivering real-time news alerts, sentiment analysis, and trend insights for investors.

Pionex

Automated cryptocurrency trading platform offering 16 free built-in trading bots with low fees and aggregated liquidity.

Analytics of Value Sense Website

🇺🇸 US: 30.21%

🇦🇪 AE: 6.64%

🇮🇳 IN: 6.43%

🇨🇦 CA: 6.01%

🇩🇪 DE: 5.34%

Others: 45.37%