Salient

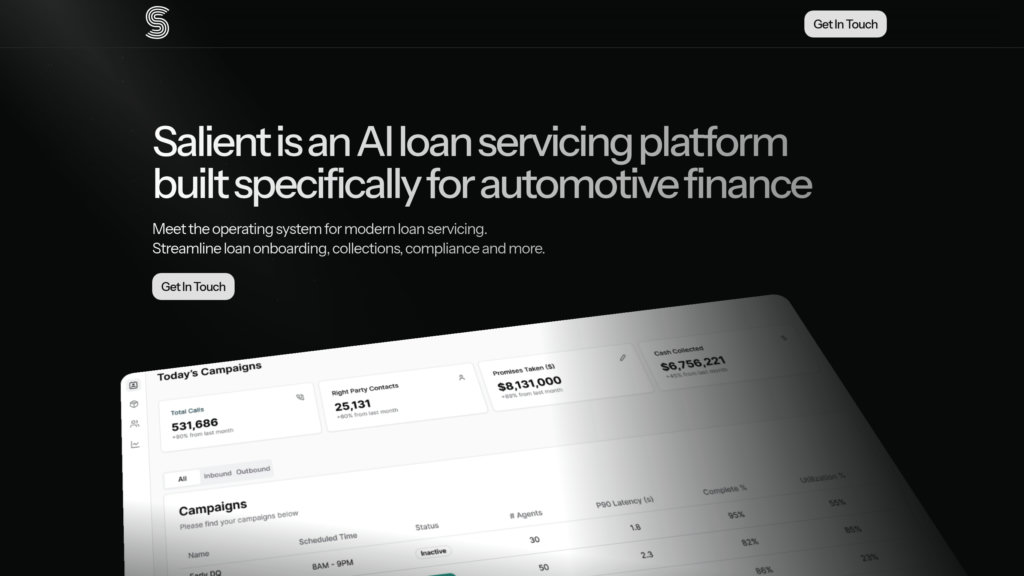

AI-driven loan servicing platform tailored for automotive finance, automating customer interactions and ensuring compliance.

Product Overview

What is Salient?

Salient is a specialized AI platform designed to transform automotive loan servicing by automating inbound and outbound communications. It leverages generative AI to handle customer interactions across voice, texting, email, and webchat, optimizing outreach timing and ensuring strict adherence to financial regulations. The platform integrates seamlessly with existing lending systems, enhances payment processing, and provides robust security with SOC 2 and PCI L1 compliance. Salient's AI agents are purpose-built for financial services, delivering compliant, efficient, and secure customer service that reduces operational costs and improves customer satisfaction.

Key Features

Purpose-Built Compliance

AI agents trained on CFPB, FCRA, TILA, and UDAP regulations with real-time monitoring to ensure all interactions meet strict financial compliance standards.

Multi-Channel Automation

Automates communications across voice calls, two-way texting, email, and webchat to streamline customer engagement and reduce manual workload.

Seamless Integration

Works effortlessly with existing automotive lending stacks, including popular loan management systems and payment processors.

Advanced Payment Processing

Enables effortless collection and processing of payments, including early delinquency calls, promise noting, and extensions.

Enterprise-Grade Security

Ensures data privacy and protection with SOC 2 and PCI L1 certifications, dedicated private clouds for each lender, and regular penetration testing.

Live Interaction Insights

Provides live transcription, summarization, and escalation detection to promptly address customer concerns and improve service quality.

Use Cases

- Automotive Loan Servicing : Automates customer communications and payment collections for automotive lenders, reducing operational costs and improving compliance.

- Customer Support Automation : Handles inbound requests like payment inquiries and extensions, freeing up human agents for complex tasks.

- Fraud Detection : Real-time verification of customer identities and detection of fraudulent activities during interactions.

- Outbound Sales and Collections : Optimizes outreach timing and personalizes messaging to increase contact rates and payment collections.

- Regulatory Compliance Management : Maintains consistent documentation and audit trails to support regulatory audits and reduce institutional risk.

FAQs

Salient Alternatives

RivalSense

AI-powered competitive intelligence platform delivering weekly curated updates from 80+ data sources to monitor companies effectively.

Pulppo

Comprehensive real estate platform for LATAM agencies, providing tools for property listings, analytics, CRM, and operational support.

Spatial.ai

Consumer segmentation platform for retail brands that organizes households into behavioral segments based on real-world social, mobile, and transaction data to optimize location strategy and targeted marketing campaigns.

Canvs AI

Insight platform that rapidly transforms open-ended text into nuanced consumer and employee feedback analysis with rich emotional context.

Monterey AI

A product insights platform that automates the collection, triage, and analysis of user feedback from multiple sources to deliver actionable product intelligence in real time.

Billabex

AI-powered automated debt collection software that personalizes payment reminders across multiple channels to optimize invoice recovery and cash flow.

GiveCampus

Comprehensive educational fundraising platform that streamlines donor engagement, event management, and wealth screening with integrated AI-powered tools.

Inari

AI-native feedback analytics platform that unifies and automates customer feedback analysis to surface actionable product insights and prioritize backlogs.

Analytics of Salient Website

🇺🇸 US: 70.59%

🇮🇳 IN: 10.69%

🇫🇷 FR: 3.18%

🇨🇭 CH: 3.06%

🇩🇪 DE: 2.65%

Others: 9.82%