Osfin

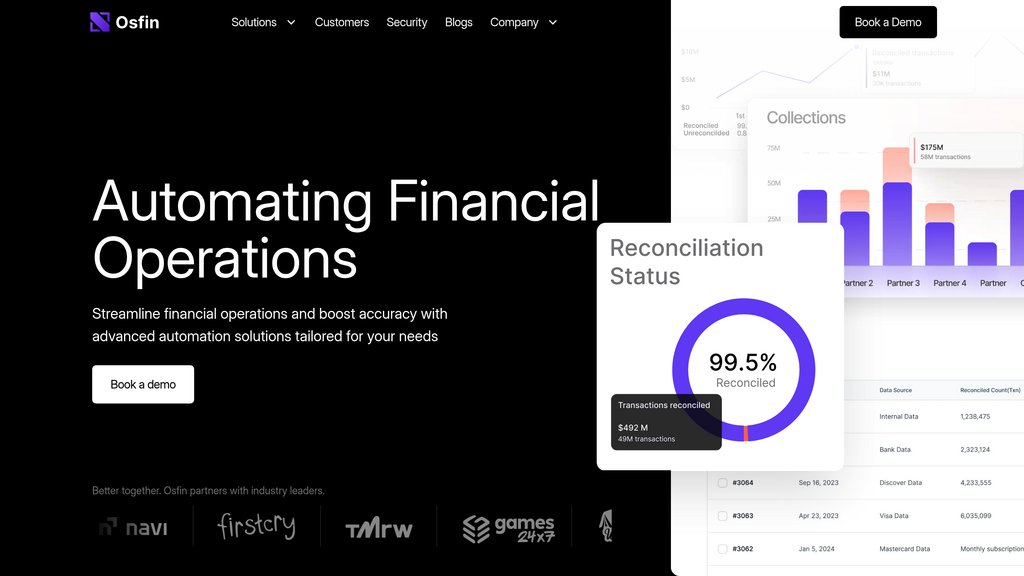

Financial operations automation platform specializing in high-speed reconciliation for payments, deposits, loans, and multi-industry transactions.

Community:

Product Overview

What is Osfin?

Osfin is a comprehensive financial automation platform designed to streamline reconciliation processes across diverse industries. The platform handles high-volume transaction reconciliation for ACH, deposits, loans, payments, and invoices with exceptional speed and accuracy. Built on a low-code framework with over 170 integrations, Osfin enables finance teams to process millions of entries rapidly while maintaining complete visibility over cash flow. The solution serves fintech, insurance, capital markets, gaming, retail, and payment processing sectors, offering customizable workflows that adapt to specific business requirements.

Key Features

High-Speed Reconciliation Engine

Lightning-fast processing capability that handles millions of transaction entries with rapid data computation from ingestion to matching and output delivery.

Multi-Industry Adaptability

Specialized reconciliation solutions tailored for payments, lending, insurance, capital markets, gaming, and retail operations with industry-specific configurations.

Low-Code Integration Hub

Seamless connectivity with 170+ data sources and platforms through a low-code framework that simplifies implementation and data processing.

Customizable Workflow Configuration

Highly agile platform allowing teams to tailor reconciliation rules, payout validations, and reporting processes without extensive technical resources.

Real-Time Financial Visibility

Comprehensive dashboards and reporting tools providing actionable insights into financial data, cash flow, and reconciliation status across all operations.

Use Cases

- Payment Processing Automation : Fintech companies and payment processors can reconcile high-volume payment transactions across multiple channels with improved accuracy and reduced manual effort.

- Lending Operations Management : Financial institutions can automate loan reconciliation and payment tracking, enabling teams to focus on growth rather than manual data verification.

- Insurance Transaction Handling : Insurance providers can manage complex premium collections, claims payments, and commission reconciliations with specialized automation workflows.

- Capital Markets Settlement : Trading firms can maintain accurate reconciliation of high-volume trades, positions, and cryptocurrency transactions with rapid processing speeds.

- Multi-Channel Retail Reconciliation : Retailers can consolidate and reconcile transactions from online, in-store, and third-party platforms to achieve unified financial visibility.

FAQs

Osfin Alternatives

OutlierDB

AI-powered platform for efficient detection and management of outliers in datasets to improve data quality and analysis.

Hawk AI

Comprehensive AML and fraud surveillance platform enhancing financial crime detection and compliance efficiency.

Prolific

A crowdsourcing platform providing high-quality, verified human data for research and AI model training with rapid participant recruitment.

iMyFone

Comprehensive software suite offering data recovery, device unlocking, system repair, and data management tools for iOS, Android, Windows, and Mac devices.

Brex

A modern finance platform offering integrated corporate cards, expense management, and business banking solutions.

Scale AI

Comprehensive AI data platform delivering high-quality labeled data, dataset management, and enterprise-grade generative AI solutions.

Accountable

All-in-one AI-powered finance app for self-employed professionals in Germany, covering bookkeeping, invoicing, banking, and taxes with guaranteed accuracy.

Aspire

All-in-one AI-powered financial platform designed for modern businesses to manage multi-currency accounts, corporate cards, expenses, payments, and accounting automation.

Analytics of Osfin Website

🇮🇳 IN: 93.77%

🇺🇸 US: 6.22%

Others: 0.01%