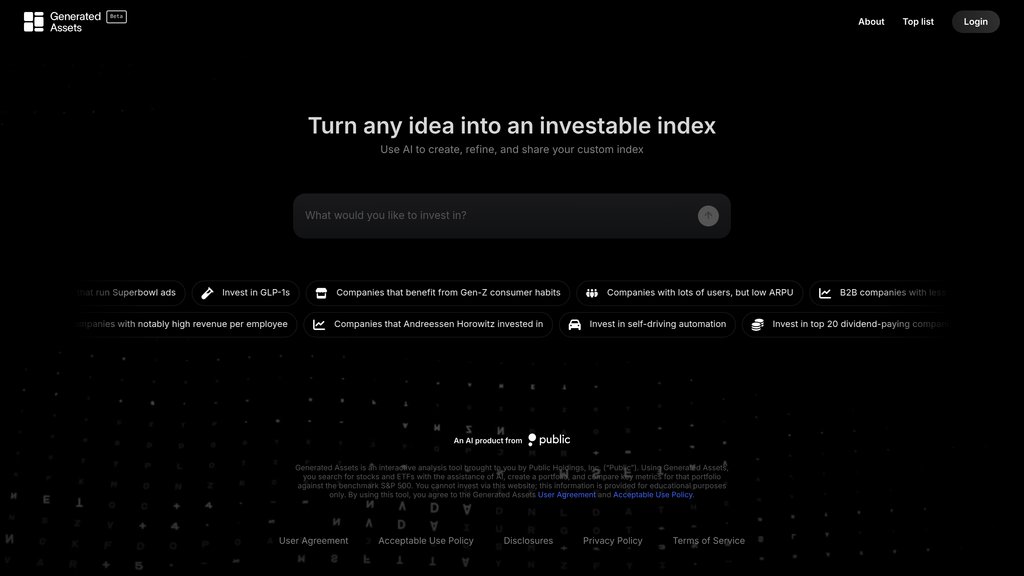

Generated Assets

Interactive investment tool that transforms any investment idea into a tradeable index using natural language processing.

Product Overview

What is Generated Assets?

Generated Assets is an innovative investment platform from Public.com that democratizes portfolio creation by allowing users to describe their investment ideas in plain text and automatically generating customized stock indices. The platform screens thousands of stocks to build tailored investment portfolios based on user concepts like 'sustainable energy companies' or 'AI-driven medical technology.' Users can track real-time performance, compare historical returns against benchmarks like the S&P 500, and invest directly through the platform with costs as low as $0.01 per share.

Key Features

Natural Language Processing

Convert vague or complex investment concepts into precise stock selections by simply describing ideas in plain text, with the system automatically matching relevant companies.

Real-Time Performance Tracking

Monitor index performance in real-time across mobile and web platforms with dynamic portfolio adjustment capabilities and instant price fluctuation updates.

Historical Benchmark Comparison

Compare generated indices against major benchmarks like S&P 500 and Nasdaq-100 with historical return analysis to evaluate investment strategy effectiveness.

Rapid Index Generation

Create customized investment indices containing 10-15 stocks in approximately 30 seconds, significantly reducing the complexity of investment decision-making.

Low-Cost Direct Investment

Invest directly in generated indices with minimal barriers, featuring costs as low as $0.01 per share and no requirement for professional investment knowledge.

Use Cases

- Thematic Investing : Create personalized indices based on specific interests like 'esports industry,' 'green energy,' or 'AI chips' to align investments with personal values and market trends.

- Beginner Portfolio Building : New investors can quickly generate diversified portfolios by inputting simple concepts, reducing the learning curve and entry barriers to stock market investing.

- Strategy Validation : Experienced investors can test and validate investment strategies by comparing generated indices' historical performance against established benchmarks.

- Mood-Based Investing : Social media-driven investors can create portfolios based on current trends and sentiments, supporting the growing 'mood investing' movement among younger demographics.

- Market Response Trading : Active traders can quickly adjust portfolio weights and respond to market changes during earnings seasons or significant market events.

FAQs

Generated Assets Alternatives

Streetbeat

Investment platform offering data-driven strategies and personalized portfolio management with advanced market analysis.

Bobby

Bobby is a smart investment assistant that builds tailored portfolios, executes trades, and manages risk dynamically within an all-in-one AI trading platform.

Laika AI

Decentralized AI platform integrating blockchain to deliver advanced market analysis, smart contract security, and real-time crypto insights.

金灵AI

Specialized financial investment research platform combining multiple AI models with real-time market data for comprehensive stock analysis.

Finlo

AI-driven platform offering expert-curated, high-return stock portfolios with monthly updates and customizable portfolio building.

Arta Finance

Digital wealth platform unifying investments, financial planning, and exclusive private market access with advanced tools and transparent pricing.

Tykr

AI-powered stock screener and education platform that simplifies investing, reduces risk, and enhances confidence for retail investors.

LevelFields AI

A stock trading platform that identifies profitable opportunities by analyzing market events affecting stock prices across thousands of companies.

Analytics of Generated Assets Website

🇺🇸 US: 48.09%

🇩🇰 DK: 28.98%

🇹🇷 TR: 22.92%

Others: 0%