Cascading AI (Casca)

AI-powered loan origination system that automates 90% of manual effort in small business and commercial lending, boosting efficiency and conversion rates.

Community:

Product Overview

What is Cascading AI (Casca)?

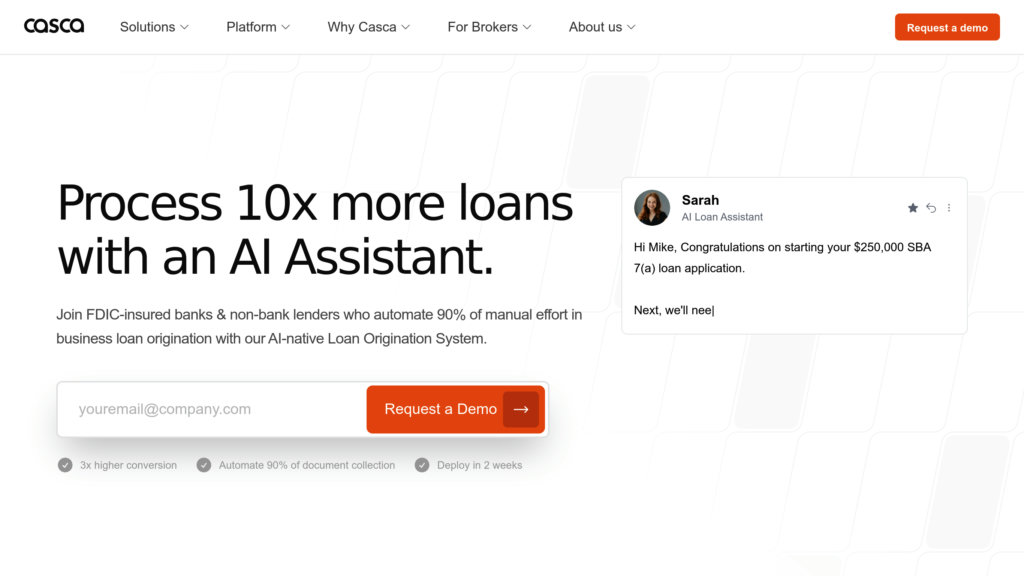

Cascading AI, branded as Casca, is a pioneering AI-native loan origination platform designed to transform the lending process for banks, credit unions, and non-bank lenders. By leveraging advanced conversational AI and computer vision, Casca automates complex workflows such as document collection, credit analysis, and Know Your Business (KYB) checks. Its AI Loan Assistant, Sarah, interacts with applicants in real-time, guiding them through the loan application process, improving lead quality, and accelerating loan decisions. Casca integrates seamlessly with existing banking systems and complies with stringent regulatory standards, delivering a secure, scalable, and user-friendly solution that significantly reduces manual labor and loan cycle times.

Key Features

AI Loan Assistant

Conversational AI agent 'Sarah' manages applicant interactions 24/7, collects and analyzes documents, and provides personalized support to increase conversion rates and reduce manual follow-ups.

Automated Document Collection and Analysis

Utilizes computer vision to read and process financial documents, automating up to 90% of manual document handling and accelerating underwriting.

Streamlined Online Loan Application

Modern, mobile-friendly application form that applicants can complete in under 5 minutes, optimized for high conversion with customizable branding.

KYB & Credit Underwriting Automation

Automates Know Your Business checks and credit analysis to reduce loan cycle times by up to 5 days, ensuring faster and more accurate lending decisions.

Security and Compliance

Built for regulated banking environments with SOC2-level security, data privacy compliance, audit logs, and human-in-the-loop monitoring to ensure regulatory adherence.

Seamless Integration and Support

Easily integrates with core banking and reporting systems via APIs, with ongoing 24/7 operational monitoring and client support.

Use Cases

- Small Business Loan Origination : Enables banks and lenders to originate up to 10x more small business loans with significantly less manual effort, improving applicant experience and operational efficiency.

- Commercial Lending Automation : Streamlines complex commercial loan processes by automating document handling, underwriting, and customer communication.

- Customer Service Enhancement : Provides round-the-clock AI-driven applicant support to answer queries, guide document submissions, and reduce drop-offs.

- Back-Office Process Optimization : Automates exception handling and problem-solving in back-office workflows to maintain smooth banking operations.

- Regulatory Compliance Management : Ensures all AI-generated outputs comply with banking regulations through integrated compliance policies and human oversight.

FAQs

Cascading AI (Casca) Alternatives

Heron Data

Automates document-heavy workflows by extracting, validating, enriching, and syncing data directly into existing systems.

Monkt

AI-powered document transformation platform converting PDFs, Word, Excel, PowerPoint, and web pages into structured Markdown or JSON with semantic preservation.

Cradl AI

A no-code platform that automates data extraction from diverse document types with high accuracy and integrated human review.

OLOCR

Free and unlimited online OCR service supporting multiple languages and batch processing for images and PDFs.

Instabase

Enterprise platform that automates extraction, classification, and analysis of unstructured data to streamline workflows and enhance decision-making.

Midship

AI-powered platform automating financial audit procedures and complex document data extraction with high accuracy and seamless integration.

Soff AI

Supply chain operating system automating data entry, supplier communication, and procurement workflows for manufacturers.

Allganize AI

Enterprise-grade platform for document understanding, workflow automation, and customizable large language model solutions deployed on-premise or cloud.

Analytics of Cascading AI (Casca) Website

🇺🇸 US: 54.22%

🇮🇳 IN: 11.62%

🇵🇰 PK: 7.92%

🇨🇦 CA: 5.73%

🇩🇪 DE: 5.66%

Others: 14.84%