Arc

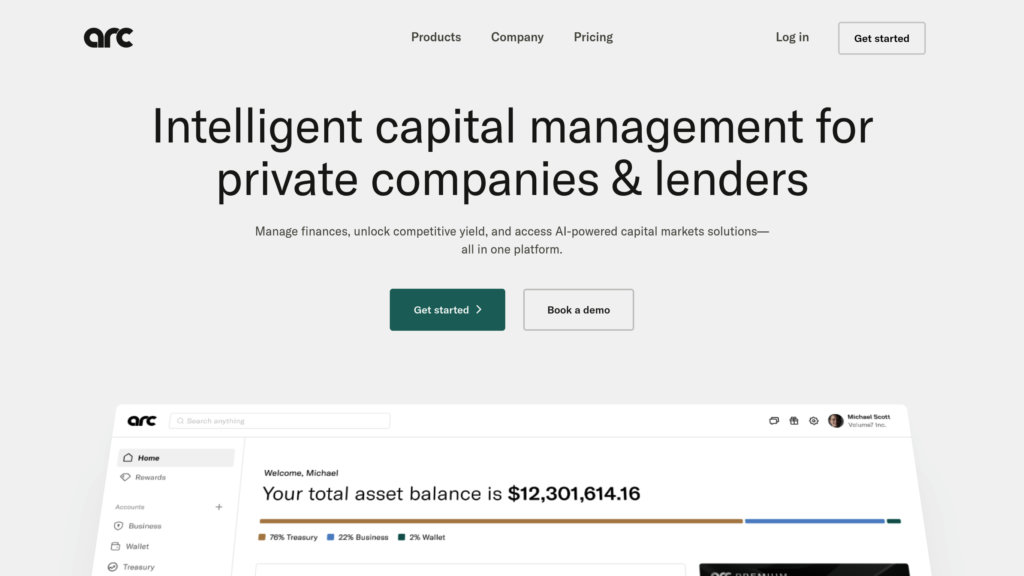

Financial technology platform providing intelligent cash management and capital market solutions tailored for startups and private investors.

Community:

Product Overview

What is Arc?

Arc is a fintech company specializing in advanced cash management and capital market services designed specifically for startups and private investors. Founded in 2021 and headquartered in San Francisco, Arc integrates with leading financial institutions and private credit funds to offer yield-bearing accounts, treasury management with zero fees, and premium banking experiences. Its platform combines financial products like unlimited ACH and wire transfers, virtual and physical debit cards, and automated transfers with dedicated support and innovative AI-driven tools to optimize financial operations and decision-making for tech companies.

Key Features

Yield-Bearing Accounts

Operating accounts that earn competitive yields through diversified financial partners and U.S. Treasury investments, delivering up to ~5.5% APY.

Zero Fee Treasury Management

Treasury services with no management fees, maximizing returns on startup cash balances.

Dedicated Relationship Management

24/7 personalized support with onboarding assistance and data-driven financial insights tailored for startups.

Advanced Financial Tools

Access to Arc Intelligence and automation tools that streamline cash management, accounting integrations, and financial analysis.

Robust Security Features

Real-time alerts, in-app ACH debit reversals, and ACH blocking to protect business funds and prevent unauthorized transactions.

Flexible Capital Solutions

Exclusive access to venture debt, revenue financing, and working capital lines to support startup growth.

Use Cases

- Startup Cash Management : Startups can optimize cash flow with yield-bearing accounts and automated payment tools, enhancing runway and financial flexibility.

- Financial Operations Automation : Businesses leverage Arc’s automation features for invoicing, bill pay, and transfers to reduce manual workload and errors.

- Capital Access for Growth : Tech companies gain access to venture debt and financing options to fuel expansion without diluting equity.

- Enhanced Financial Security : Companies protect their funds with real-time monitoring and fraud prevention features integrated into the platform.

- Data-Driven Financial Insights : Founders and CFOs receive actionable insights and advisory services to make informed financial decisions.

FAQs

Arc Alternatives

Titan

AI-native wealth management platform leveraging advanced AI technologies to deliver personalized, data-driven financial advisory services.

FinanceGPT

AI-powered platform combining generative AI with financial data and expert knowledge to deliver actionable financial analysis and forecasting.

Valuemetrix

AI-powered investment platform delivering real-time analytics, deep portfolio insights, and personalized financial recommendations.

Lofty AI

AI-powered real estate platform enabling fractional property ownership through tokenization with daily rental income and advanced investment analytics.

Stock Unlock

AI-powered investment platform delivering comprehensive stock analysis, portfolio tracking, and educational tools for confident investing.

AInvest

Integrated AI-powered investment platform offering stock analysis, real-time market insights, and portfolio management for smarter trading.

StockStory

StockStory is a financial research platform that delivers in-depth stock analysis, market insights, and investment ideas focused on high-quality companies with strong fundamentals.

DealStream

AI-powered deal sourcing platform providing access to businesses, investment properties, and funding opportunities with personalized recommendations.

Analytics of Arc Website

🇺🇸 US: 55.57%

🇳🇬 NG: 7.39%

🇿🇦 ZA: 3.79%

🇻🇳 VN: 3.63%

🇮🇳 IN: 3.29%

Others: 26.33%